Trésor-Economics No. 101 - Is gold still a safe haven?

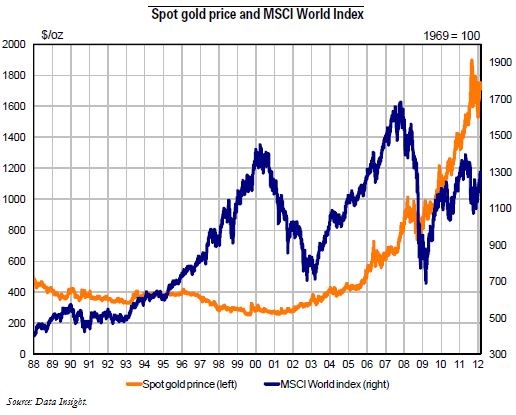

Since the inception of the financial crisis, the price of gold has evolved as a safe haven, i.e., an asset whose return is uncorrelated or negatively correlated with the return on another asset in periods of financial market tensions: the performance of gold, the price of which has risen from $650 per ounce ($650/oz) in June 2007 to close to $1650/oz in April 2012, thus contrasts with the performance of riskier assets (see chart below), such as the MSCI World Index of developed stock markets (MSCI World), which has fallen by 18% over the period.

The recent evolution of the gold price, however, does not appear to be consistent with the safe-haven assumption: after peaking at over $1950/oz in September 2011, the price of gold trended downward, in tandem with risky assets, in Q4 2011.

This apparent shift can be explained by increased financial market tensions, which were very strong in autumn 2011, and the appreciation of the dollar, the currency in which gold is denominated.

An econometric analysis suggests that the gold price behaves differently, depending on the degree of financial stress. In periods of moderate stress, gold is indeed a safe haven, as the return is negatively correlated with stock returns. On the other hand, in periods of extreme stress, stock and gold returns are generally positively correlated, probably because investors are then forced to reduce their positions on gold, a liquid asset, to cover their losses on other asset classes.

The recent decline in the gold price may also be linked to the appreciation of the dollar: gold can act as a hedge against currency exposure for investors holding dollar-denominated assets. The negative correlation between the return on gold and the USD exchange rate is particularly pronounced in periods of very high volatility, when it is close to unity for some currency pairs (dollar-euro and dollar-Swiss franc).