Trésor-Economics No. 100 - The impact of Japan's earthquake on the global economy

A year ago, Japan's triple disaster-earthquake, tsunami and nuclear accident-had a very strong impact on the Japanese economy. In addition to its dramatic human cost, the catastrophe destroyed production capacity in the disaster zones and caused a power supply shortfall. It also negatively impacted the national and international economy through disruption of production chains-the factor that ultimately made the largest contribution to the sharp drop in production in Japan and neighboring economies.

For the full year 2011, Japanese GDP was 0.7% lower than in 2010. The largest decline was in the first two quarters (– 1.8% and – 0.3%, respectively), followed by a significant rebound in Q3 (+1.7%), before a further fall in Q4 traceable to the global slowdown and flooding in Thailand.

The disaster's direct impact on the global economy ultimately turns out to be limited. Japan's supply-side shock at the end of Q1 changed little in the demand addressed to its main trading partners. The decline in Japanese demand was partly counterbalanced by higher imports to offset the transient shortfall in domestic supply, notably for energy. All in all, the decline in Japanese imports was very slight, especially in comparison with the decline in exports.

The indirect effect transmitted through globalized production chains was significantly larger, both in Japan and in the rest of the world. As a quasi-monopoly supplier of key technological products for the electronics and automotive industries, Japan has a strategic position at the heart of global production chains. The disaster caused production chain disruptions in those industries; the impact was particularly visible in the Asian countries, notably because Japan supplies those countries with a higher percentage of their imports of intermediate goods than other parts of the world.

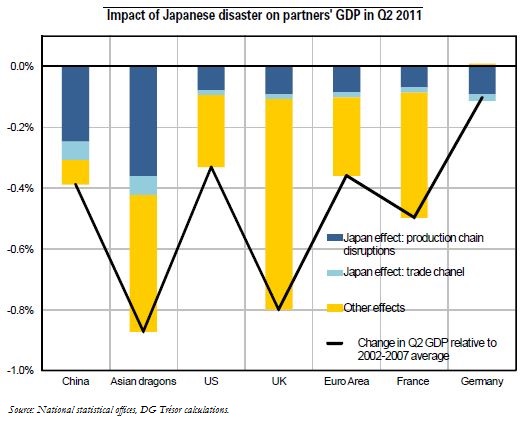

GDP in the major economies grew at a far lower rate in Q2 2011 than in the past, partly due to the earthquake in Japan; this was especially the case in Asia. The total impact of the disaster in Q2 is found to be 0.4 points of GDP for the Asian dragons, 0.3 points in China, and 0.1 point in Europe and in the US, with the automotive sector particularly affected. The impact is found to be virtually zero over the full year 2011, on the strength of the H2 rebound following restoration of both Japanese production capacity and global production chains, with a subsequent positive impact in 2012 because of public sector reconstruction.