Trésor-Economics No. 96 - The state of the world economy in autumn 2011: a fragile recovery

The world economy is still convalescent. The 2008-2009 crisis grew out of deep imbalances in the advanced economies, and in particular out of excessive levels of household, corporate and/or government debt. Stimulus plans have mitigated the consequences of this crisis, but at the cost of rising public debt, even though the process of private debt reduction has barely begun. It will take time to clean up economic agents' balance sheets, and global activity could hiccup considerably in the process.

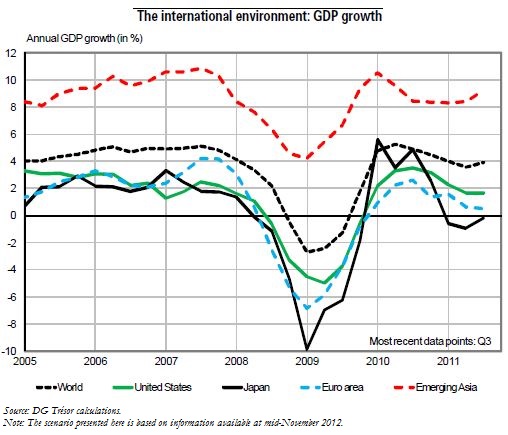

Consequently, after a fairly strong upturn in 2010, the world economy slowed in the first half of 2011, due in particular to rising commodity prices and the Sendai earthquake in Japan.

During the summer, bad news from the United States (namely a downward revision of growth, the sovereign rating downgrade, etc.) and European sovereign debt fears sparked a pronounced market correction. This financial turbulence sapped agents' confidence, especially among business heads, with the latest business sentiment surveys reporting a sharp downturn in the growth outlook. The global slowdown is therefore likely to continue to the end of the year, especially given governments' limited room for manoeuvre at present. In many of the developed economies, European in particular, fiscal policy is focused on consolidation while monetary policy is already highly accommodating. The emerging economies are in a more favourable situation, however, still enjoying strong growth.

The world economy is expected to pick up in 2012. Private sector growth drivers (productive investment and household consumption) should resume progressively in the advanced economies. Japan's reconstruction effort too should support global activity, as should continuing strong growth in the emerging economies, in Asia especially. Without an exchange rate adjustment, the rebalancing of current accounts-which could revitalise global activity-would be very limited and would concern only a handful of countries.

Global recovery remains seriously at risk, however, the gravest risk being heightened tensions in the financial markets, in Europe especially. Spillovers of these tensions to the real economy, notably via the credit channel, could lead to a contraction of activity in some advanced economies, especially in Europe, in Q4 2011, correspondingly hampering world growth in 2012.