Tresor-Economics No. 95 - International trade integration and consumer prices in Europe, 1998-2008

By encouraging economies to specialize in sectors where they enjoy a comparative advantage, globalization has helped restrain price rises for many goods. In most of the OECD countries this effect has been relatively modest on the overall consumer price index (some 0 to ¼ of a percentage point annually since 2000) but it has proved to be far greater for goods widely traded in the international markets (the so-called "global goods" or "tradable goods"), fossil energy excluded.

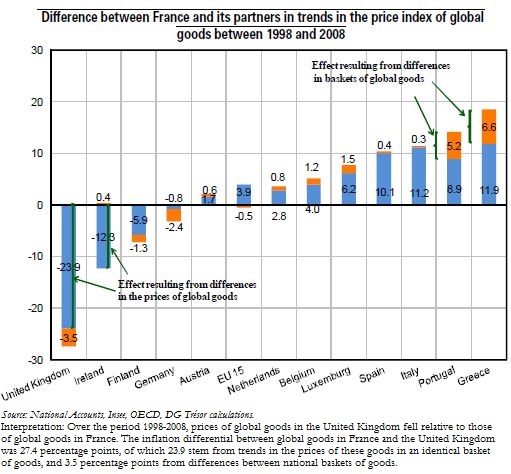

Among European countries, there are wide disparities between inflation differentials for global goods. This is partly because households in these countries consume different quantities of global goods, whose price has risen less (due to the structural effect). Second, this lower rate of inflation for global goods can also be accounted for by pure price effects, which themselves depend on country-specific features: the degree of penetration of imports from the emerging countries, initial price level, or again changes in distribution sector regulation.

For example, consumers in the United Kingdom langely benefited from this downward impact on prices resulting from international trade integration, global goods inflation being distinctly lower in the United Kingdom than in the eurozone, over the period 1998-2008. This cannot be explained by moves in exchange rates. Greater liberalisation of distribution sector regulation, a higher initial price level relative to the eurozone, and to a lesser extent a higher proportion of global goods in UK consumers' shopping baskets, explain this gap.

France is closer to the European average. French consumers have benefited less than British or German consumers from the impact of international trade integration, but more so than Spanish or Italian consumers.

A study of price index trends by income group in France shows that the relatively well-off households are those that have benefited most from this lower inflation, the least well-off households spending a greater proportion of their income on "non-global goods" such as housing and agrifood products.