Trésor-Economics No. 91 - How will 2010 pensions reform contribute to the sustainability of public finances after the crisis?

The economic crisis of 2008-2009 has increased pressure on the public finances of most developed countries, against a background of ageing populations, adding to doubts as to their sustainability.

A country's public finances are considered to be sustainable when it is capable of funding its public debt over the very long term with no change of policy. Sustainability depends on both short and long-term factors. In the short term: is the public balance appropriated enough to prevent the debt ratio from rising out of bounds? In the long term: how will the effects of population ageing (pensions, health spending and long-term care or "dependency") affect the public balance in future decades?

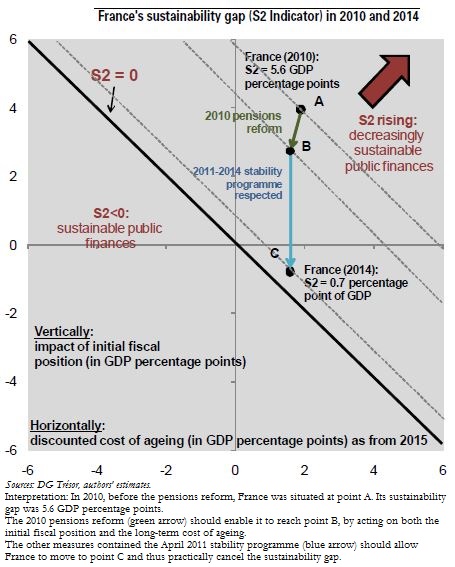

The sustainability gap at a given date represents the durable effort, in GDP percentage points, required from that date on in order to restore sustainability, either by cutting public spending or by increasing revenues. By measuring this we can assess the relative importance of short and long-term factors.

For France, respecting the path for the public balance set forth in the April 2011 stability programme, which includes the pensions reform, spending cuts and reductions in tax expenditures and social welfare insurance loopholes, would start to bring down public debt as from 2013 and would close much of the sustainability gap: this would represent less than 1 percentage point of GDP in 2014, versus around 5½ percentage points in 2010.

Of these 4¾ GDP percentage points improvement, nearly 1 point is reckoned to flow from the 2010 pensions reform, and especially from the raising on the retirement age. By phasing in this reform rapidly, much of the reform's effect would be concentrated in the years between now and 2014. The pensions reform would therefore improve the sustainability gap (S2) essentially through an improvement in the short-term balance.

Once the public finances have been brought back into balance, France could find itself in a relatively favourable position relative to its main European partners, thanks to lower ageing-related costs.