Trésor-Economics No. 90 - Why has investment resumed in France despite low capacity utilization rates?

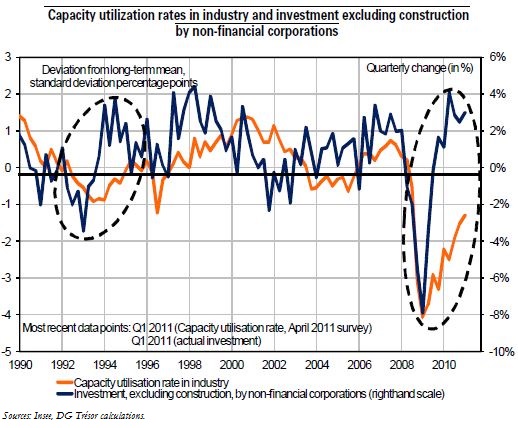

French industry's capacity utilization rate has picked up progressively, after falling sharply during the crisis. Even so, in early 2011 it was still well below its long-term average. Yet despite this under-utilization of existing stock of capital, non-financial corporations resumed investing as early as the second quarter of 2010, and even as early as fourth-quarter 2009 for productive investment excluding construction.

This apparent paradox-low capacity utilization and dynamic investment-is not specific to the present cycle of the crisis. This configuration has already occurred in the past, notably in the 1993 crisis, even if the 2008-2009 crisis saw a far larger fall in the capacity utilization rate.

Both theoretical and practical arguments suggest the capacity utilization rate should be treated with caution as a predictor of investment. On the one hand, industry accounts for only utilizing 20-25% of productive investment in France and is therefore not entirely representative of capacity utilization across the economy as a whole. On the other, from a theoretical standpoint, an increase in investment in a context of low capacity utilization is possible when expected demand far exceeds current demand. In that case, it may be profitable for a firm to invest today in order to smooth its capital stock adjustment costs, even if that means under-utilizing its existing capacity.

Other indicators are surely more relevant for short-term investment forecasting. To begin with production bottlenecks or opinions concerning industry's production capacity are presumably more representative than the capacity utilization rate of pressures on capacity, which is merely an average indicator. Secondly, some indicators have indeed heralded the investment upturn: Insee's quarterly indicator of industrial investment, the services sector survey with its specific questions on investment in the services sector, and to a lesser extent the survey of business owners' expectations of future activity in the wholesale sector. These three sources have proved more reliable than the capacity utilization rate in forecasting the short-term pace of investment in the recent period.

The investment recovery registered since mid-2010 could thus spring from the expectation by many firms of strong expected stabilizing demand and from their desire to smooth their capital stock adjustment costs.