Trésor-Economics No. 86 - Neither deflation nor inflationary spiral in the United States: what can be learnt from a sectoral model of core inflation

Opinions on the inflation outlook diverge in the United States. The economic recovery, rising energy prices, and the current monetary policy of the Federal Reserve (Fed) now lead some observers to predict an "inflationary spiral." For others, the under-utilization of productive capacity, high unemployment, household debt reduction, and a still-troubled real-estate market suggest the opposite scenario: the persistence of very low inflation-or even a "deflationary risk."

While changes in total inflation are largely driven by fluctuations in energy prices, the overall price trend is better captured by a less volatile measure: inflation less energy and food prices, known as "core" inflation. On present evidence, the knock-on effect of energy prices on other prices and on wages (the "second round" effect) in the United States seems modest. This finding downplays the risk of an "inflationary spiral," sometimes mentioned in the U.S.

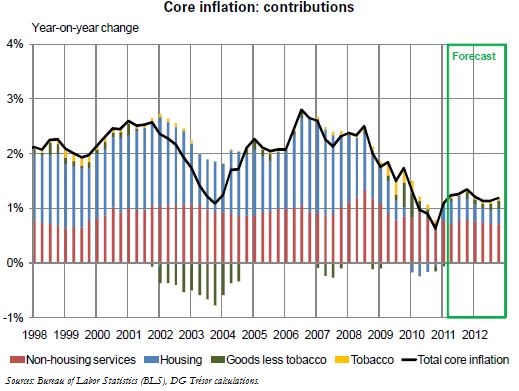

Our study shows that the dynamics of U.S. core inflation can be usefully captured by analyzing its three sectoral components: prices of housing (approximately 40% of the index), prices of non-housing services (slightly more than 30%), and prices of goods (slightly less than 30%). Our model identifies the determinants of price changes in the three sectors and enables us to predict the change in core inflation from the variations in each component.

The aggregation of sectoral results suggests moderate core inflation of around 1% in 2011 and 2012.

This analysis, therefore, rules out two risks for the time being: a persistence of the deflationary trend observed since 2008 (and, a fortiori, a "deflationary risk"), and an inflationary spiral. It also allows a better analysis of the Fed's monetary policy and provides some grounds-given the institution's remit-for moderating the criticisms directed against that policy.