Trésor-Economics No. 82 - Convergence and "deconvergence" of living standards in the New Member States of the European Union

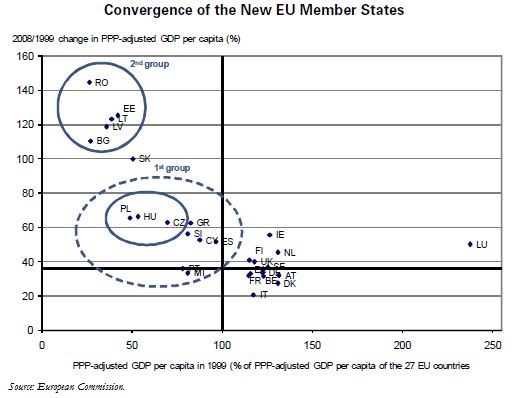

Living standards in the New Member States of the European Union (NMSs) converged very rapidly towards the average European standard of living over the first decade of the new century. In many countries in the region, such as the Baltic countries and Bulgaria, GDP per capita adjusted for purchasing power parities (PPP), which is an indicator for comparing living standards between countries, increased by more than 100% between 1999 and 2008, whereas the same indicator for the Member States of the euro area increased by only 30% on average.

However, the rates of convergence of the NMSs' living standards were not the same over the period under review (1999 to 2008). The NMSs can be divided into two groups according to their path of convergence. The first group is made up of Poland, Hungary and the Czech Republic, where the living standard was the highest in the NMS group in 1999 and where the convergence rate over ten years was slower than in the countries in the second group, made up of the Baltic countries, Bulgaria and Romania.

The financial crisis seems to have had a major impact on economic growth in the countries of the region, derailing the various catching-up processes under way, especially in the second group of countries that had previously registered rapid convergence. PPP-adjusted GDP per capita declined in all of the NMSs between 2008 and 2009. The countries with fastest convergence rates saw particularly sharp decreases between these two years.

An extrapolation of PPP-adjusted GDP per capita for 2010 shows that the standard of living resumed its rise in most NMSs between 2009 and 2010, but at a slower pace than during the period from 1999 to 2008. This confirms that a lasting "deconvergence" does not seem to be occurring, but the financial crisis may have hampered the convergence process.

Once again, the slowdown in increases in living standards in 2010, compared to the previous decade, is more pronounced for the countries of the second group.

The sharpness of the slowdown in the countries in the second group stems in part from macro-economic imbalances. This should encourage them to adopt more balanced and sustainable growth strategies.