Trésor-Economics No. 81 - The global economic outlook in autumn 2010: how are the components of recovery lining up?

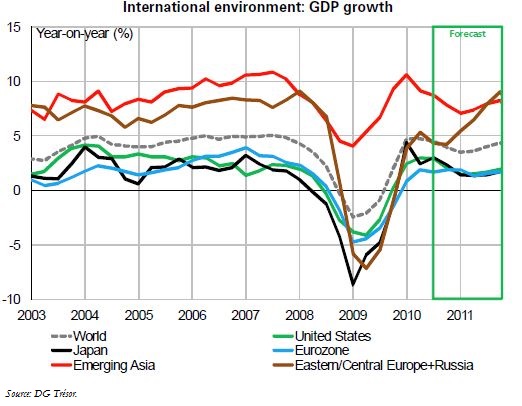

Since the first stirrings of spring, the advanced economies have entered a phase of moderate recovery. As expected, the first half of 2010 was more buoyant than the latter half of 2009 for most of the world's leading economies, for the eurozone especially. The pickup in activity since summer 2009 rested largely on the recovery in global trade, and in particular on growth in trade with China and emerging Asia, which have created the necessary additional demand to spark the advanced economies back into life. International trade is expected to maintain this momentum over the next two years, supporting the advanced economies.

Other factors too drove the spring 2010 rebound: in addition to temporary factors such as public stimulus plans and the inventory cycle, the healthy performance of the developed countries in first-half 2010 also reflected reviving domestic private domestic demand. In fact, two contradictory trends are at work here: fading temporary factors, with the expiration of the stimulus plans, and the progressive ramping up of private-sector growth drivers, allowing domestic demand in the developed countries to consolidate, looking to 2011.

At the same time, the trade imbalances are likely to revert to a situation similar to that of 2008, meaning that the partial rebalancing seen in 2009 could have been largely cyclical in fact.

In most of the developed countries, labour productivity is thought to have recovered at the expense of jobs. Only in the United States and China is GDP expected to recover its 2008 level by 2011, but employment is expected to revert to its 2008 level only in Germany, where it hadn't risen very much anyway. Combined with wage restraint in some countries, reviving productivity would help to restore mark-ups. These, together with improved funding conditions, would set the scene for an investment revival, except in Spain, where it would continue to be held back by weak domestic demand.

Finally, after having fallen 0.9% in 2009, global GDP is expected to grow by 4.4% in 2010 and 3.9% in 2011, thanks largely to the emerging countries. Considerable uncertainties remain, however, both as regards the real economy and the financial sphere.