Trésor-Economics No. 73 - Global economic outlook, winter 2010: the first snowdrops are blooming

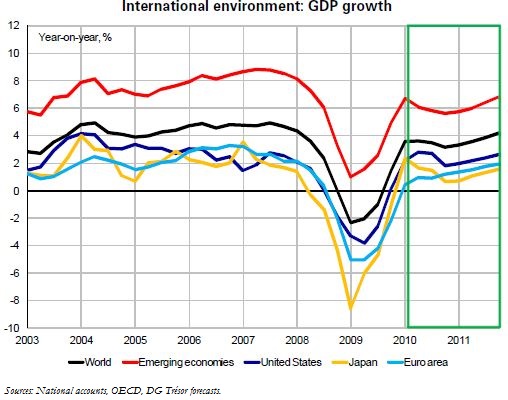

After the great recession of 2008-2009, global activity stabilized in the spring of 2009 and picked up in the summer, when most economies emerged from recession. But the recovery is fragile: in Q4 2009, when the rebound was confirmed in the United States and Japan, activity faltered in most European countries.

The economic rebound has been so far driven by stimulus plans and the inversion of the inventory cycle. But conditions now favour the emergence of a gradual recovery led by world trade, which benefits from vigorous demand in emerging countries. Inflation is contained, except in Japan where it is expected to remain negative.

Domestic imbalances, however, are a constraint to the recovery in the medium term. Since 2000, economic growth in the U.S., the U.K. and Spain has been based on a strong expansion of credit to households, primarily mortgage loans. Also, European firms often financed their investments with excessive debt leverage. Most governments turned to borrowing, piling public debt on top of private debt. Absorbing these imbalances will take considerable time, as households cope with unemployment and negative real-estate wealth effects, and firms are burdened by large unutilized capacities and modest demand-which fail to create an incentive to invest despite higher margin rates.

A lower-than-expected saving rate and a stronger rebound on financial markets could fuel a sharper pickup. On the other hand, deepening global imbalances or greater deflationary pressures would increase the downside risk to the economy.

2009 saw a great recession, but also the start of the recovery: global GDP fell 1.0% in 2009, and should now rise by 3.4% in 2010 and 3.7% in 2011.