Trésor-Economics No. 71 - Trends in the French housing market

The French housing market is characterized by inadequate growth in supply relative to growth in the number of households.

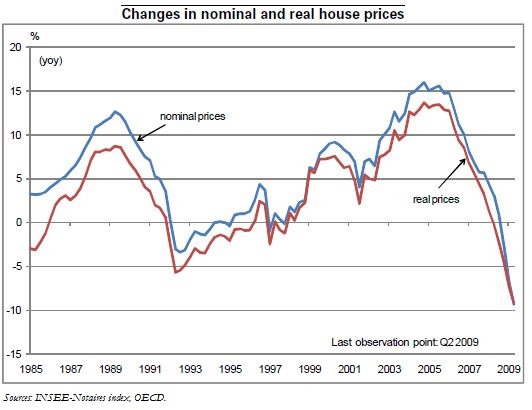

From 2003 to 2007 the acceleration in demand arising from the easing of financial conditions, new tax incentives, and probably the speculative nature of some property investments, led to increased pressure on prices.

In a symmetric manner, the downturn in the housing market since 2007 reflects first of all a decline in demand, in a context of tighter financial conditions and prices considered too high with respect to changes in incomes and rents.

The price decline nevertheless remains limited by the downward elasticity of the housing supply, with reductions in the inventories of new housing put on the market and strong declines in building permit applications and housing starts.

The concomitant slowdown in housing supply and housing demand has translated into a marked reduction in activity in the residential construction sector.

The housing market downturn should remain distinctly less pronounced than in the US or Spain due to specific features of the French market, including low household debt, the lack of a subprime mortgage market, and implementation of measures to support both the supply side and the demand side of the housing sector.

The recovery in new-home sales since the start of 2009 and the resulting decline in inventories, if confirmed in the figures for the second half of 2009, could augur the beginning of an improvement in activity sometime in 2010. However, in the very short term, the most likely scenario appears to be a continuing decline in housing prices at a moderate rate (in year-on-year terms)-despite initial signs of an upward trend in quarter-on-quarter terms.