Trésor-Economics No. 70 - The global environment market and the outlook for French eco-businesses

The environment market has expanded very rapidly since 1970. Initially confined to pollution cleanup services, it has expanded over the past ten years with the emergence of "clean" products and technologies in most sectors of the economy.

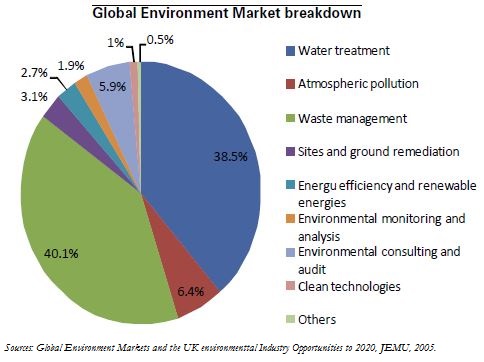

It is still hard to form a picture of the environment market in statistical terms due to the lack of any standardised definition. The United Nations Environmental Programme (UNEP) currently estimates it at €1,400 billion or 2.5% of global GDP. It is expected to expand swiftly over the coming years, at a rate of around 10% annually. This growth will be driven mainly by new sectors such as renewable energies and energy efficiency, and by the emerging countries such as China, the world's number one manufacturer of photovoltaic cells.

The distinguishing feature of the environmental market is that its emergence and growth has been largely driven by government intervention, via regulation and pricing policies. Despite persistently strong misgivings, the growing awareness of environmental issues is giving rise to increasingly proactive policies, spurred in the recent past by the green stimulus plans.

France is the world's fifth-largest exporter, and its firms include world leaders in water and waste, nuclear power and railways, but its positions remain weak in the "new" environmental technologies such as renewable energies, energy storage, batteries for clean vehicles, etc., which are forecast to grow strongly. Consequently, it lacks the optimal specialisation needed to make the most of the global "green" growth.

France does not enjoy the competitive advantage in these technologies that local eco-businesses can gain from the early introduction of environmental regulations and pricing policies in the domestic market. But it can make good its relative backwardness through policies to stimulate innovation within the framework of the "Grenelle de l'Environnement" (environment round table) and the National Loan.