Trésor-Economics No. 69 - Reducing French corporate debt: why and how?

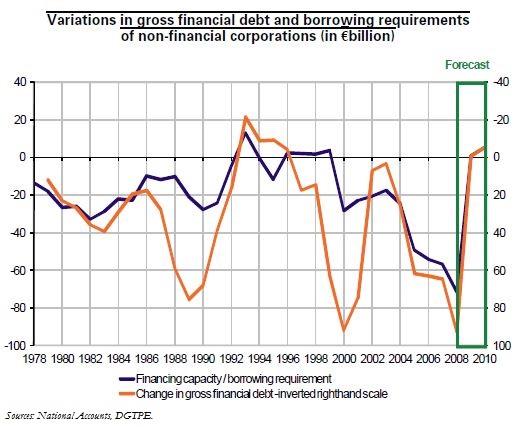

Non-financial corporations registered a sharp increase in their debt between 2004 and 2008 (by 10 percentage points of their value added). By 2008 this had reached 121% of their value added (€1,203 billion).

This increase in debt since 2004 appears unrelated to the acquisition of financial assets, unlike in the late-1990s. Against a background of relatively stable mark-ups and rising dividend payouts, the increase in corporate indebtedness since 2004 mainly reflects the need to finance steeply rising investment. The borrowing requirement rose from 2.9 percentage points to 7.2 percentage points of value added between 2004 and 2008.

Low interest rates facilitated this growth in indebtedness, by limiting the corresponding financial burden (insolvency rates remain low). In addition, most of this debt is long-term, thereby limiting the risk of illiquidity. However, companies may seek to reduce their debt in the aftermath of the 2008 financial crisis.

Two debt reduction episodes, in 1991-1998 and in 2001-2003, led to a slowdown in investment by non-financial corporations, to reduced dividend payments and, in the latter period, to asset sales. According to the forecasts appended to the 2010 Budget Bill, companies are expected to bolster their financing capacity thanks mainly to tax cuts (in particular the business tax reform), inventory rundowns, falling investment and pay restraint, all of which should help to reduce their debt.

The reform of the business tax and measures to boost corporate liquidity and that of banks (in return for a commitment on their part to go on lending), are helping to reduce the risk of a forcible debt reduction, which would be harmful to investment.