Trésor-Economics No. 66 - Global economic outlook, Autumn 2009

The turmoil at the end of 2008 and the beginning of 2009 was followed by a lull in Q2 2009. With the stimulus plans starting to take effect, the pace of decline in activity slowed and certain countries even posted positive growth. This, coupled with the improvement seen on the financial markets, has tended to confirm the scenario of a gradual stabilisation of activity.

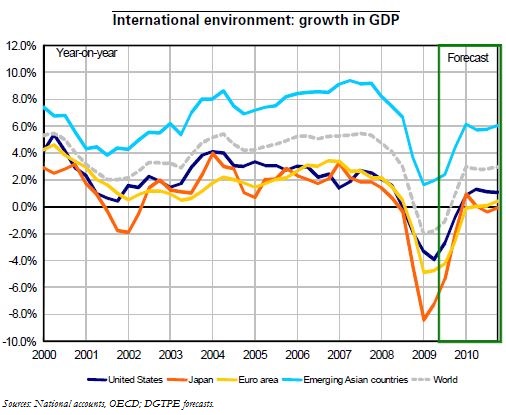

The upturn is likely to remain fragile, however. As a result of the sharp rise in mortgage lending throughout the 2000s, the debt ratio of households in the United States, the United Kingdom and Spain rose, making their financial situation unsustainable. In the euro area, it is the non-financial firms that are highly indebted. Absorbing these internal disequilibria could take time. Household consumption can be expected to remain relatively slack. Meanwhile, corporate investment is likely to continue to be affected by the continuing modest growth prospects. World trade, which is set to recover following the tumble during the winter, is unlikely to show real recovery until some time in 2010. All in all, following a decline in 2009 that has no precedent in the post-WWII period, activity will probably have difficulty in picking up significantly in 2010.

At the same time, uncertainty is likely to be fuelled by the uneven time-profile of the upturn, this being explained by, among other things, the timing of the implementation of the stimulus plans and by the inventory cycle. The upturn could show a more or less steady pattern in the United States, Japan and Germany. In certain countries, it may not last if the medium-term growth engines are lacking, either because households and firms remain too heavily in debt (Spain, United Kingdom) or because competitiveness gains remain small in the medium term (Italy). In this context of weak activity (world growth of – 1.0% in 2009 followed by +2.9% in 2010), inflation is set to decline appreciably. In the United States, core inflation excluding rents is likely to be close to zero in 2010, while in Japan prices are likely to fall again.