Trésor-Economics No. 59 - Distributable surplus and share-out of value added in France

The distributable surplus is the share of GDP growth available to improve the remuneration of factors of production. It stems from two sources, namely productivity gains and changes in the amount appropriated by the rest of the world through variations in the terms of trade. Consequently it is the share of growth not allocated to the remuneration of additional factors of production as measured by the price of utilisation in the domestic market.

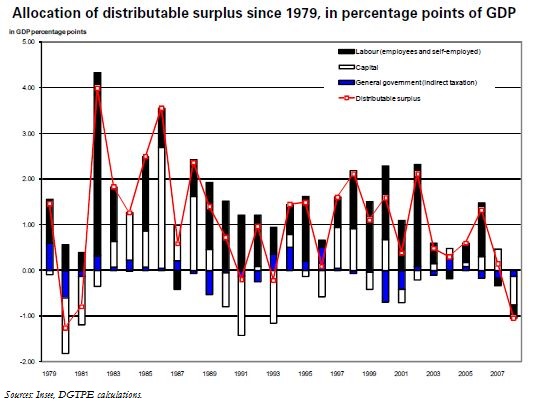

The distributable surplus is apportioned among general government departments via changes in indirect taxation, employees and non-employees via changes in hourly wages, and holders of capital via changes in the return on capital.

The distributable surplus has declined sharply, on average, since the 1980s, largely due to slower productivity growth, which has fallen by more than 0.5 percentage points of GDP. The annual distributable surplus has been less than one percentage point of GDP, on average, since the beginning of the 1990s.

Since the 1990s, most of the distributable surplus has been used to increase the remuneration of labour, which is consistent with the theoretical allocation when growth is balanced. The remuneration of capital, on the other hand, has fluctuated between the beginning of the 1990s and the 2000s, serving to absorb the changes in indirect taxation.

The decline in the remuneration of labour in value added (VA) in the 1980s resulted more from the substitution of capital for labour than from a decline in the remuneration of labour relative to capital. This is not incompatible with a redistribution of the surplus in favour of workers. The stability in the apportionment of VA since the beginning of the 1990s reflects a combination of capital/labour substitution and allocation of the distributable surplus to labour.

The year-to-year volatility of the distributable surplus is chiefly due to that of energy prices. These cyclical shocks are absorbed mainly by the remuneration of capital.