Trésor-Economics No. 57 - Foreclosures in the United States and financial institutions' losses

The rate of mortgage defaults by American households began rising rapidly in summer 2006, precipitating first the property crisis, and then the financial crisis starting in summer 2007. The number of foreclosures has gone on rising since that time, one effect of which has been to depress house prices. Uncertainty over the total number of future foreclosures, meanwhile, is preventing financial institutions from understanding the scale and distribution of their losses, thus feeding the climate of distrust that is hindering the distribution of credit to the economy.

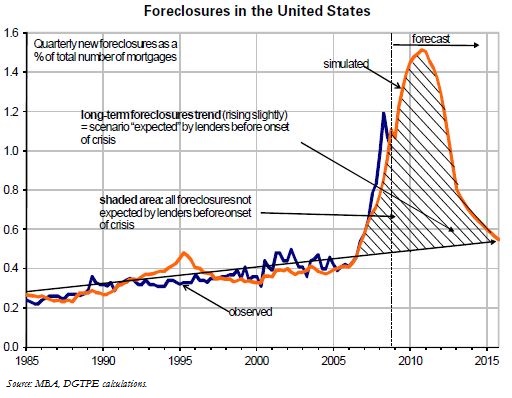

To understand the past behaviour of foreclosure rates and predict their future development, this is modelled as a function of its macroeconomic determinants, i.e. house prices, interest rates, unemployment, and an indicator of loan "quality". That is because the chief cause of the increase in foreclosures between 2006 and 2008 was the easing of lending criteria by lenders, especially via the distribution of what are known as subprime loans.

Foreclosures are set to go on rising until 2010 or even 2011, mainly as a result of falling house prices, as many households find themselves in a situation of negative equity (i.e. their house is worth less than the outstanding portion of their mortgage). This increases their propensity to default, particularly in states such as California, where they can walk away from their home without having to repay the rest of their loan.

Altogether, an estimated 17 million homes will have been foreclosed between the onset of the crisis in 2006 and the return to normal in 2015, incurring losses to American financial institutions in the region of $1,150 billion, this estimate being very close to that of the IMF.