Trésor-Economics No. 56 - Unconventional monetary policies, an appraisal

The major Central Banks have cut their key rates sharply in recent months in response to the rapid slowdown in the economy. These conventional monetary policies have shown their limitations, however. In the first place, central banks have little room for manoeuvre: target rates are now between 0 and 0.25% for the Fed, 1.25% for the ECB, and 0.5% for the Bank of England (BoE). Second, despite previous rate cuts, monetary and financial conditions have deteriorated further. Finally, the financial crisis has weakened channels for the transmission of conventional monetary policies.

Consequently, the central banks have implemented unconventional monetary policies, in the first place in order to tackle the liquidity crisis in the interbank market, and then, when the limits to cutting key rates became clearer, with a view to improving overall financing conditions for the economy.

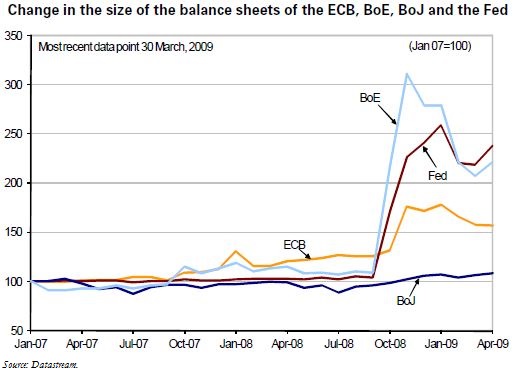

The measures taken by the ECB have resulted in a 45% expansion of its balance sheet between September 2008 and January 2009. These measures have primarily sought to boost the liquidity of the interbank market, while the other central banks (the Fed, the BoE and the BoJ) have also sought to influence the price of certain financial assets (public or private) through their purchases.

The measures taken by the other central banks have pushed down interest rates right across the yield curve, putting downward pressure on their currencies, especially vis-à-vis the euro, which could worsen deflationary pressures in the euro area. This is what happened, for example, after the Fed's announcement of its Treasury bonds purchase facility on Wednesday 18 March, when the euro gained nearly 5% against the dollar. This situation prompted the President of the ECB to announce that the Governing Council intended to decide on new non-standard measures at its meeting on 7 May. He also said that the main refinancing rate of 1.25% could be cut further if circumstances warranted.