Trésor-Economics No. 55 - Global economic outlook, Spring 2009

In the fall of 2008, the financial crisis expanded, leading to a sharp contraction of activity by year's end. In countries where growth was largely debt-based, and whose populations are very sensitive to the wealth effect (US, UK and Spain), a steep fall in financial asset prices and tougher financing conditions resulted in a sharp drop in domestic demand. For export-oriented countries (such as Germany and Japan), it was chiefly the drop in exports that caused the rest of the economy to stumble.

Faced with this situation, governments and central banks set about restoring confidence in the financial markets, recapitalising the banking systems and propping up the real economy. The central banks slashed interest rates, and implemented a series of "unconventional" policies (liquidity injections, and direct purchase of both public and private securities). Stimulus plans announced by the various governments included spending measures designed to strongly support growth. At the same time, household purchasing power was given a lift by lower inflation resulting from the drop in the prices of oil and commodities.

For countries that need to reduce their debt levels and excessive investments, the process of consolidation will no doubt take time. In Spain and the UK, activity will likely continue to contract throughout 2009, whereas the US should manage to get back to positive growth thanks to the size and scope of its recovery plan.

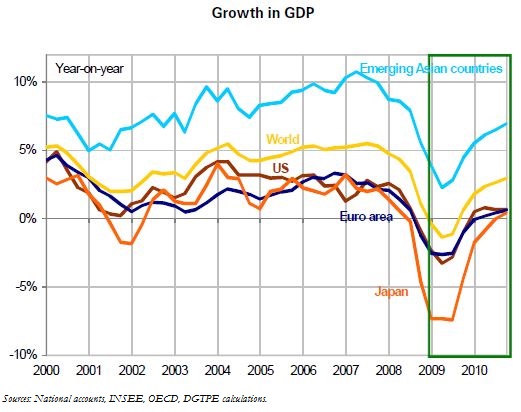

Given the rather sluggish outlook for 2009 (– 0.6% world growth) and 2010 (2.4% world growth), inflation should decrease sharply. In the US, core inflation excluding rents should basically be zero at the end of 2010, whereas the appreciation of the yen will likely push Japan back into deflation starting in the first six months of 2009.

This painful and particularly uncertain scenario is subject to more unknown factors than normal.