Trésor-Economics No. 53 - Agri-food industry margins in France

The price of agricultural commodities rose sharply between 2007 and mid-2008. The downstream impact of this increase on food prices paid by consumers depends on relations between suppliers and supermarket chains, and on their relative bargaining power. In theory, this is determined primarily by the respective degrees of concentration among suppliers and supermarket chains, together with other factors such as product differentiation, regulations, and the dynamic effects of competition within a long-term vertical relationship.

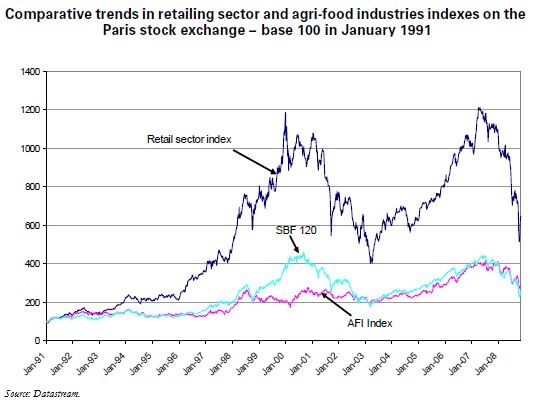

For several decades now, the relationship between supermarket chains and suppliers has tilted heavily in favour of the former, because of the greater concentration in that sector. Firms in the agri-food industries (AFI) do indeed appear to be less profitable than those in the retail sector in France, but this observation embraces a variety of situations. The performance of SMEs in the AFI sector is deteriorating, and this is partially offset by strong performances by a handful of very large firms. The relative situation of the AFIs overall deteriorated between the middle of the 1990s and 2005, with price variations mainly benefiting supermarket chains. Yet the profitability of the French agri-food sector is in line with the average for the main developed countries, the disparity vis-à-vis the supermarket chains stemming rather from the French supermarket chains' atypical profitability, as witnessed by the profit ratios of the leading retailers and the market capitalisations for the sector.

The recent reforms have extensively overhauled the regulatory framework, particularly where retailing is concerned. It is not possible, based on currently available data, to measure precisely the effects of this new balance of power on margins in this sector. Nevertheless, stock market trends suggest that the effects of these reforms have begun to make themselves felt since 2006.