Trésor-Economics No. 47 - The global economic outlook in the autumn of 2008

In the summer of 2008, even before suffering the consequences of the abrupt worsening of the financial crisis in mid-September, the world economy was faltering.

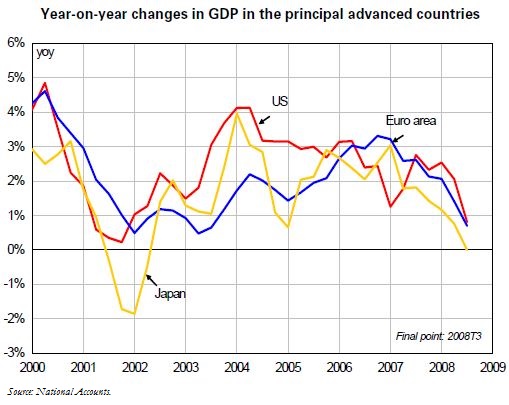

By the summer of 2007, growth around the world had already started to slow down. This was due to the impact of the depressed American housing market on world financial markets starting in August 2007, and to the rise in commodity price – oil hit a record high of $147 a barrel in July 2008. In a single year, growth was down in nearly every industrialised country, and negative growth was even observed in the euro area and Japan in Q3 and Q4, and in the US and the UK in Q3. Although emerging countries proved to be relatively resilient, China's growth slowed in Q3.

Starting in mid-September 2008, the financial crisis worsened considerably, particularly after the failure of Lehman Brothers, causing credit to dry up and stock prices to fall. A widespread lack of confidence caused financial institutions to deleverage and to tighten lending to households and businesses. Thanks to large-scale intervention on the part of the authorities, specifically recapitalisation of companies in difficulty, the financial sector has stabilised but has remained extremely fragile as of early November 2008.

The impact of the financial crisis on the real economy has taken several forms, including tighter credit, decreased confidence and negative wealth effects. The prospects for global growth in 2009 appear dim indeed.

In the wake of the crisis in western economies, growth should also slow in emerging countries.

In the context of wide-scale uncertainty concerning the future of the world economy, the drop in the price of oil and commodities since the summer and changes in economic policy should help to lessen the negative effect on growth.