Trésor-Economics No. 46 - Economic catch-up and price-level convergence in the countries of Central and Eastern Europe (CEE)

As their economies catch up, the real exchange rates of Central and Eastern European (CEE) countries are appreciating, which means that domestic prices are rising faster than in the euro area. This is a typical feature of transition economies, reflecting sharp gains in labour productivity and a sizeable accumulation of productive capital, which ultimately leads to convergent price levels.

The way in which real exchange rate appreciation occurs in CEE countries (via a rise in the nominal exchange rate or an inflation rate differential with the euro zone) is nevertheless liable to have an impact on their economic situation and on the pace of price convergence, given their status as EU Member States.

Under flexible exchange-rate regimes, real appreciation may to a large extent take place via an appreciation of the nominal exchange rate. This dampens inflationary pressures and allows the central bank to maintain positive real interest rates, having no exchange rate target. Relatively stable domestic financing conditions ensure a sufficient level of savings, which limits macroeconomic and financial imbalances.

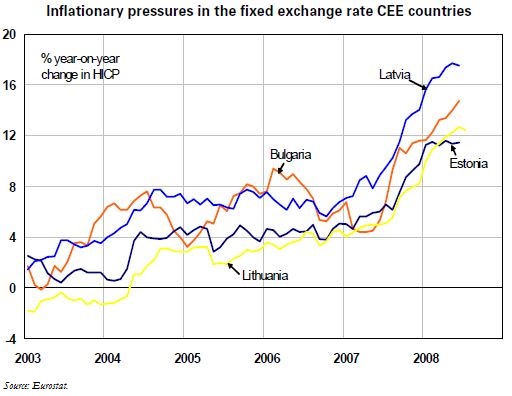

Choosing a fixed exchange rate reduces exchange rate risk and its attendant risk premium. However, strong inflationary pressures stemming from real appreciation may lead to the emergence of negative real interest rates in a situation conducive to nominal interest-rate convergence, thus fuelling economic overheating. Expansionary financing conditions are likely to encourage rapid credit growth and boost asset prices sharply, notably property prices. The dynamism of domestic demand may in turn lead to excessive real exchange rate appreciation, accompanied by a widening of external deficits and rising external debt.

Countries that decide to fix their exchange rate risk external and domestic imbalances that could compromise their ability to sustainably meet the convergence criteria required for euro zone accession, particularly price stability.