Trésor-Economics No. 44 - Can developments in profitability explain the strength of corporate investment?

French firms have invested heavily since the cyclical trough of 2003, even though their profit margins have remained stable. The investment rate of non-financial corporations was nearly 21% in 2007, matching the peaks reached in the early 1980s and 1990s. In Germany, on the other hand, corporations have relatively little raised their investment rates since their low point in 2004, despite sharply increasing profit margins.

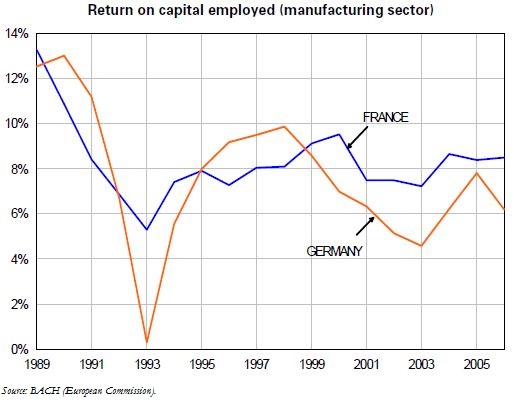

However, profit margins are a relatively restrictive measure of a company's financial health: return on capital employed (ROCE) and return on equity (ROE) represent more complete measures of performance. Indeed, profitability also takes account of the productivity of capital, together with the cost of borrowing and the financial structure of corporations. In addition, they are key variables driving investors' decisions in the financial markets.

The fact that French firms consistently achieved high rates of return throughout the 1990s and 2000s could explain their ability to attract capital and, consequently, their high rates of investment. Based on national accounts, we establish that the ROCE of all French corporations, excluding revaluation effects, remained stable at a high level throughout the 1990s and 2000s.

Moreover, this finding is consistent with the trends identified from company accounts in the manufacturing sector (from the European Commission's Bank for the Accounts of Corporations Harmonised-BACH). This sample exhibits no fall-off in the ROE of French firms relative to their German counterparts.