Trésor-Economics No. 40 - The bursting of the US house price bubble

US house prices rose by nearly 60% in nominal terms between 2000 and 2006, before starting to fall in the summer of 2007.

The price rise was driven by strong growth in housing demand coupled with relatively scarce supply due to a shortage of available land in the most urban states and, perhaps, weak competition in the construction sector. In addition, housing demand was fuelled by unsustainable factors, including easier access to mortgage loans, excessive expectations concerning house price increases and durably accommodative monetary policy.

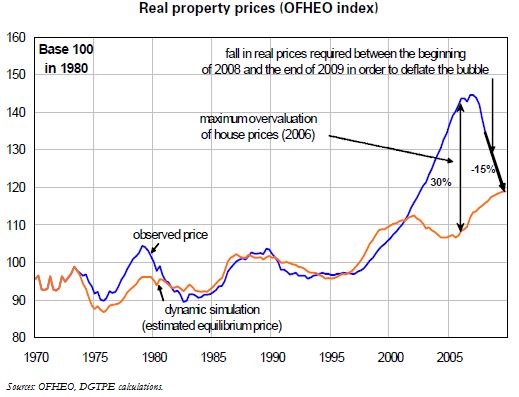

To assess the scale of the coming price adjustment, we need to know the long-term equilibrium of house prices. This depends on construction costs as well as on housing demand, given that land scarcity is a constraint on housing supply in the most urbanised states.

According to our analysis, house prices were overvalued by nearly 30% in 2006. To eliminate the bubble entirely, and taking into account the fall in prices in 2007, we estimate that real house prices would need to continue to fall by roughly 15% between the beginning of 2008 and the end of 2009, or by approximately 10% in nominal terms.

This house price decline could have serious consequences for the American economy. It could have a direct impact on activity in the construction sector, as well indirect impact on household consumption via a housing wealth effect. It could affect inflation via a slowdown in rents, which account for a hefty share of core inflation, and it could affect mortgage default rates, with consequences for financial institutions' balance sheets and hence the distribution of credit. All these factors are playing a part in the overall slowdown in the American economy.