Trésor-Economics No. 41 - The role of financial factors in rising agricultural prices

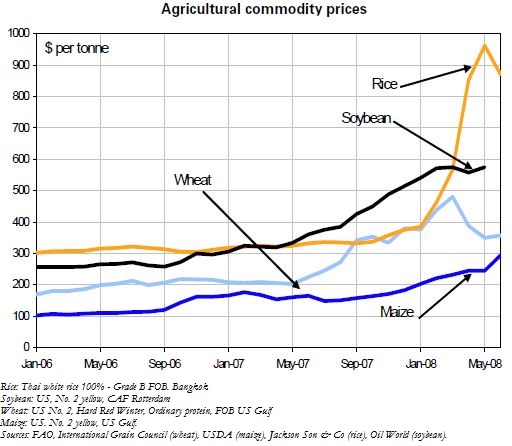

There has been a sharp acceleration in the rate of increase in world prices for agricultural commodities since 2006, coming after fifteen years of rising steadily but moderately. By percolating throughout the food production chain, rising prices of agricultural commodities are contributing to global inflation. It is important to ascertain the causes of this crisis in order to determine the most appropriate way to address it.

Demand for agricultural commodities has expanded as a result of economic growth in the emerging countries and, to some extent, the production of biofuels (in the case of certain staples such as maize). In addition, this demand for agricultural products is relatively inelastic to price.

Supply of agricultural commodities has not immediately kept pace with demand due to climate accidents in the case of the 2006 and 2007 harvests, to rising agricultural production costs, and to lags in the response of supply to higher prices. Overall, supply and demand trends are clearly contributing to the rise in agricultural commodity prices.

Financial investors are increasingly active in agricultural futures markets, and there are grounds for wondering whether their action may be helping to fuel the rise in agricultural prices.

From a theoretical point of view, the existence of futures markets, even very active ones, is not sufficient to modify spot prices durably, and still less so when storage costs are high (as in the case of cereals).

Available data suggest that the impact on spot prices of financial investment in futures markets for agricultural commodities is small compared with the impact of traditional supply and demand factors.