Trésor-Economics No. 36 - Global economic outlook, spring 2008

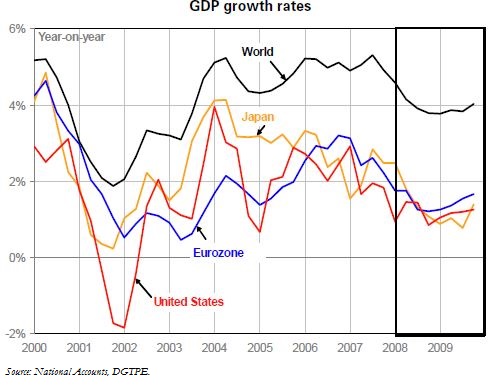

Despite adverse economic conditions in the US, with the real estate market downturn and a deteriorating job situation, combined with a shock to commodities and oil prices and the financial turbulence that emerged during the summer, the global economy remained buoyant in 2007 thanks to continuing fairly vigorous growth in Europe and emerging Asia. Growth in the eurozone was sustained mainly by robust investment and dynamic external trade. In Japan, the upturn observed at the end of 2006 and early 2007 went into reverse in mid-2007, notably with a decline in activity in the second quarter due to weaker investment; activity picked up solidly at year-end, however, thanks to a rebound in public and private investment. Meanwhile, emerging Asia maintained its exceptional growth rate of 2006, driven by China's boom.

In 2008, global activity is forecast to slow, partly as a result of the US economic downturn, and also due to the combination of a price shock (with the surge in the price of oil, agricultural commodities and food prices), and persistent financial market tensions that are expected to squeeze business investment. The inflation shock is expected to dampen consumption in the first half of 2008, particularly in countries also suffering negative wealth effects due to the property market.

In the course of 2009, activity is expected gradually to return to its potential growth rate in Europe and the United States, as the financial markets situation is normalised, inflation abates and the effects of the US property crisis are attenuated. In the emerging countries, China notably, activity is expected to gather pace again progressively in 2008 in line with expected trends in global trade.