Trésor-Economics No. 32 - Do rising food prices pose a risk of persistent inflationary pressure?

Prices of agricultural commodities rose sharply in 2006 and 2007. The causes of the trend are both cyclical and structural, which means prices could remain durably high and very volatile. Several exporting regions, especially Australia and Europe, have recently suffered climate events. Cereal and dairy production have fallen as a result, reducing inventories and causing tension in world markets. Moreover, new health crises have disrupted the markets for animal products by modifying trade flows. From a more structural standpoint, global demand for food products has risen steeply in recent years. This stems from growth in the emerging economies, which is changing people's eating habits, and from the development of biofuels.

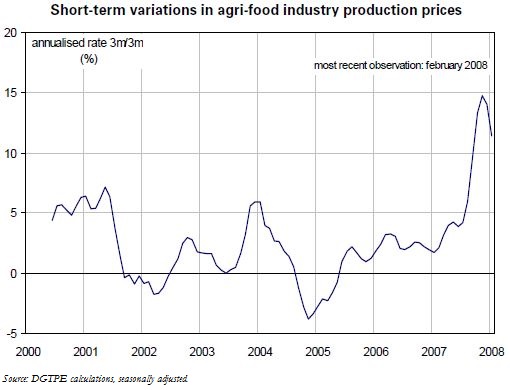

Rising commodity prices have gradually diffused to production costs of the agri-food industry, and production prices in turn accelerated significantly in the second half of 2007. Ultimately, this acceleration has spilled over into the prices paid by consumers. French food prices were rising at an annual rate of 0.8% in summer 2007, but spurted to nearly 5% p.a. in February 2008. This price surge is largely due to rising prices of agricultural commodities, but it may also reveal changes in marginal behaviour, although it is not possible to quantify their impact.

In France, the new reform of business relationships between suppliers and the supermarket chains, introduced by the "Chatel" Act, which took effect on March 1, ought to alleviate the upward pressure on prices. Moreover, the recent slower growth in production prices for the agri-food industry suggests that the peak of the shock is behind us (see chart).