Trésor-Economics No. 26 - Trends in French public spending: a retrospective survey

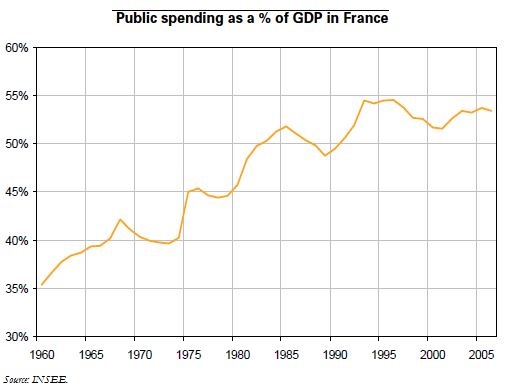

The share of public spending in GDP has risen sharply in France over the past fifty years, rising from 35 % at the beginning of the 1960s to over 50 % since the 1990s.

The rise has not been a steady one, being especially pronounced when fiscal policy was called upon to stimulate the economy (after the fiscal stimuli of 1974 and 1981). Over the long run, the main driver has been the rapid growth in social security spending due to structural factors, especially population ageing: this latter trend is expected to continue, looking to 2050.

Among OECD countries, the share of public spending in GDP ranges from 30 % for South Korea to 55.5 % for Sweden, a difference of more than 20 percentage points of GDP. France ranks among those countries where the ratio is highest. The differences chiefly reflect national collective preferences as to how the provision of needs and public goods should be financed-privately or by society. Nevertheless, the trend in French public expenditures in the recent period looks worrying by comparison with those of our neighbours: spending has continued to rise as a percentage of GDP, whereas in Germany the trend has been reversed.

According to estimates by the DGTPE, over half of the rise can be attributed to social security funds, even though their share in overall spending growth edged down slightly starting in 2005, then more distinctly in 2006 as a result of the abatement of the national healthcare expenditure target (ONDAM) and falling unemployment. Moreover, the contribution from local governments has risen, partly as a result of the transfer to them of new areas of competence voted since 2002.

Spending needs to be brought under control in order to cope with the heavy pressure on social security expenditure foreseeable in the medium term, mainly due to population ageing, and in order to bring the ratio of spending to GDP back down to the European average. The French authorities have set a target of halving the rate of growth in public spending over the lifetime of the current parliament.