Trésor-Economics No. 23 - Reduced-rate corporation tax for SMEs

Independent Very Small Enterprises (VSEs) and Small and Medium-Sized Enterprises (SMEs) frequently have greater difficulty than large firms in gaining access to outside financing. On the one hand their access to financing via the markets is very limited. On the other, banks and other lending institutions pay even greater attention to balancesheet quality and to the level of the firm's share capital than they do for large firms, owing to the greater risk of default.

VSEs and SMEs therefore need to increase their share capital. The difficulty here is that, by taxing reinvested profits and dividends paid to shareholders, corporation tax (CT) directly raises the cost of equity.

To reduce the cost of funding for VSEs and SMEs and improve their share capital, it was decided in 1996, and again in 2001, to reduce their tax burden by instituting a reduced CT rate. This reduced rate applies exclusively to independent VSEs and SMEs subject to CT. Eligible companies pay a reduced 15% rate instead of the standard 331/3% rate on a fraction of their taxable profit capped at € 38,120.

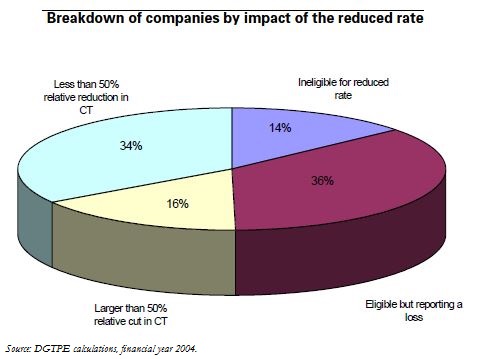

470,000 companies currently pay CT at the reduced rate. This reduced rate has rendered the tax scale progressive for eligible companies. While it is steeply progressive at the lower end of the scale, it fairly quickly becomes much less so above the € 38,120 threshold. In absolute terms, the tax gain is effectively limited to a little under € 7,000 per company. However, most companies in France are small and generate a taxable profit of only a few tens of thousands of euros. As a result, the tax charge of more than one company in three is more than halved thanks to the reduced tax rate.

Those sectors that are relatively little concentrated, where independent VSEs and SMEs account for a large proportion of firms, benefit more than the others from this reduced rate. The sectors that benefit most are building, commerce and distribution, property and personal services. Conversely, manufacturing, energy and financial activities are the sectors that benefit least.