Trésor-Economics No. 22 - Are stockmarkets overvalued?

The very sharp rise in equity prices until summer 2007, at a time when the US economy was showing signs of running out of steam, suggested that the markets were being unduly optimistic over earnings growth, especially since the latter already appeared to be very high at the beginning of the year. We consider this question here using the different types of "multiples" used in financial analysis, such as the price earnings ratio (P/E).

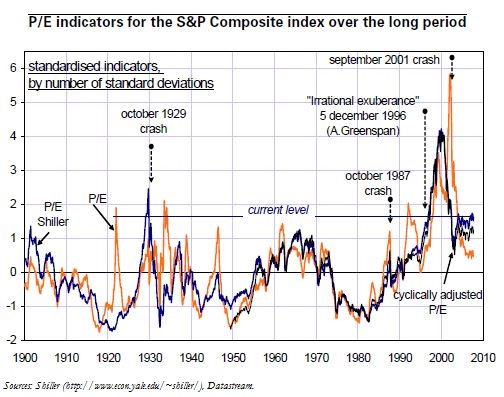

In the United States, ratios are above their long-term average but by no more than one standard deviation. Historically, the "one standard" deviation distance can be identified as the threshold beyond which a correction on financial market has generally been observed. However, at least two factors show that one cannot rule out the risk of over-valuation in the US market.

Cyclically adjusted P/E ratios turn out higher than non-adjusted ratios and thus, further away from the long term average. Indeed, the adjusted ratios appear to be better predictors of future price movements in the direction of a return to historical average P/Es.

Moreover, there may be an upward bias in the calculation of average P/Es in the United States, due to the steep over-valuations seen in the late-1990s. Allowing for this distortion would move P/Es a little further away from their long-term average. This would appear to be confirmed by the use of a very long series based on the S&P Composite going back to 1870, especially when cyclically adjusted.

In the eurozone, the stock market bull run appears to be consistent with fundamentals, in terms of both cyclically unadjusted and adjusted ratios. In other words, future market movements ought to take place in line with earnings trends. In Japan as well, regardless of the metric used, the multiples remain close to their long-term average, sometimes below, sometimes above, and thus cannot serve as early warning signals of an over-valued market.