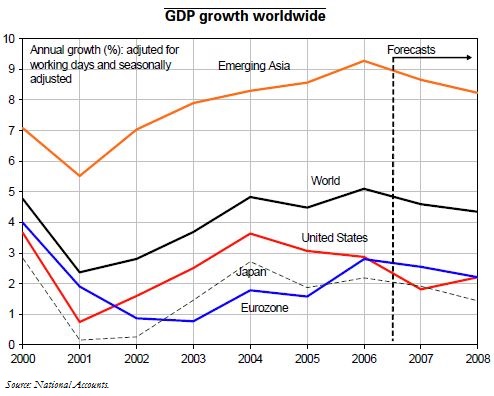

Trésor-Economics No. 21 - The global economic outlook in autumn 2007

The US economy began showing signs of slowing in mid-2006, notably due to the downturn in home building. Because of the specific nature of this shock, its impact on the economies of Japan, the eurozone and the emerging countries stayed limited. Growth remained pretty strong, particularly in the eurozone, fuelled by very buoyant investment and exports. The slowdown in the second quarter of 2007 (in Japan and the eurozone) appears to have been caused by short-term factors that do not cancel out this healthy uptrend.

Tensions in the financial markets in summer 2007 drove up risk premia and led to tougher lending conditions in the United States. These developments are likely to weigh on the US economy (and to a lesser extent on other countries such as the United Kingdom and Spain) by reducing investment in residential property and household consumption. In the corporate sector, businesses are in sound financial condition-thanks notably to relatively high cash flow-which should help them to avoid a sharp investment slowdown.

Despite these tensions, eurozone growth is forecast to remain buoyant in 2007 (2.6%), while the US economy is forecast to slow significantly, to 1.8%: the process of decoupling is set to continue.

In 2008, with the slowdown in home building abating and with faster business investment, US activity would gradually accelerate up to an annualised growth rate of around 2.5% by year-end. During the same period, the eurozone is expected to grow at a rate close to its potential (roughly 2%).

Growth in Japan is forecast to be better balanced (with more consumption and lower exports) but no longer to exceed its potential. In emerging Asia, slightly weaker investment would largely be offset by increased consumption, so that growth is forecast to remain robust.