Trésor-Economics No. 20 - Should we worry about current-account imbalances in a monetary union ?

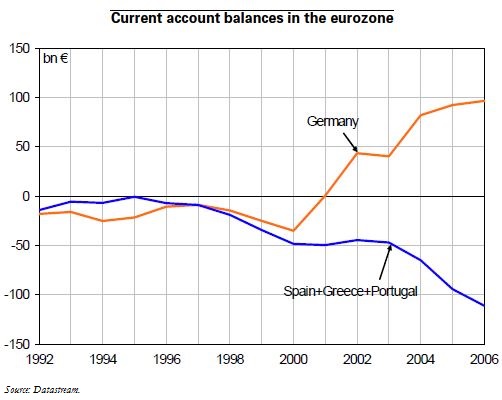

For the past several years, the eurozone current account has been nearly balanced despite divergent trends in the current accounts of individual member countries. Germany's current account has improved in the recent period, while the current-account deficits of Spain, Portugal, and Greece widened by 8.3, 9.8, and 8.1 points of GDP respectively in 2006.

In theory, these current-account imbalances are partly due to a better functioning of financial markets and the elimination of exchange-rate risk premiums resulting from monetary union-a development that has arguably lowered some barriers to capital flows and allowed greater use of international financing.

However, the overadjustment risk should not be underestimated. If current-account deficits move on an unsustainable path, countries belonging to a currency area can no longer rely on a devaluation of the nominal exchange rate, and must turn to other types of adjustments. Competitiveness adjustments are more costly when they require a cut in real wages achieved through higher unemployment. Financial adjustments cannot be ruled out either, although the notion of "country risk" is less relevant in a monetary union.

Lastly, economic policies have a role to play. Monetary authorities can be attentive to macroeconomic disparities and can act on member-country weightings in their policy management. Fiscal policies can seek to offset the demand differences between countries. Policies to stimulate productivity growth can narrow competitiveness differences, as well as certain tax policies.