Trésor-Économics No. 18 - International macroeconomic policy coordination

Under the Bretton Woods system, fixed parities vs. the dollar required that national monetary policies follow that of the United States. The demise of that system raised the question of the need for some other form of macroeconomic policy coordination.

From a theoretical point of view, coordination amounts to tailoring each country's policies to match those recommended by an "all-knowing global planner"; at first glance, this would improve their efficiency and, by eliminating their self-centred element, enable policymakers to pick superior policies in terms of resulting welfare for each country. The potential gains from coordination are significant in a certain number of cases, such as fiscal policies in a monetary union, liquidity crises, manifest exchange rate misalignment, or in a balance of payments crisis.

Despite the existence of a number of coordinating bodies such as the G7 and the Eurogroup, etc., there are constraints limiting extension of the scope for coordination. On the one hand it can conflict with domestic goals, such as domestic policy compromises or the overriding objectives and credibility of central banks. On the other, it is hard to put into practice inasmuch as its own effects are not always observable: defining common goals and verifying the different parties' commitments are no easy matter.

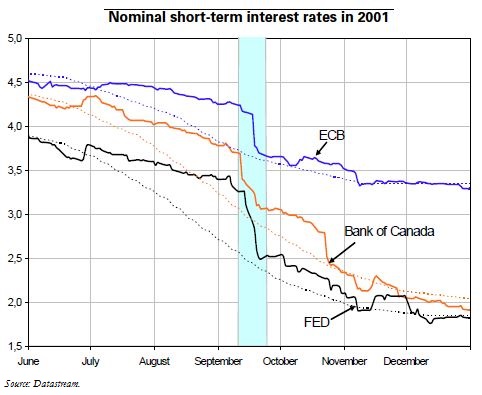

Over the past three decades, and leaving aside coordination within the European Union and, a fortiori, within the eurozone, macroeconomic policy coordination has for the most part occurred in specific circumstances, as in the aftermath of the 11 September 2001 terrorist attacks. To avert any risk of a financial crisis, the central banks undertook on that same day to meet all demands for liquidity on the part of banks. On 17 September 2001, the Fed, the ECB and the Bank of Canada decided simultaneously to cut their respective key rates by 50 basis points (see chart opposite).