Trésor-Economics No. 12 - The Global Economic Outlook, spring 2007

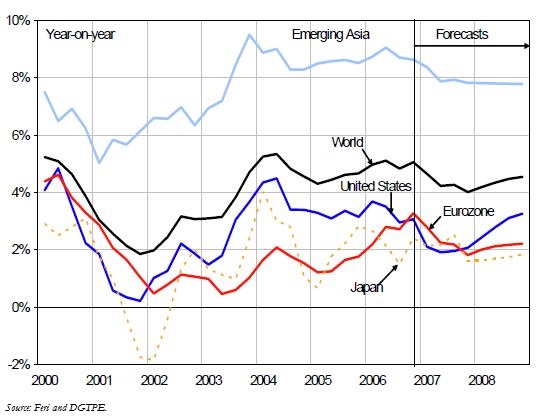

The balance of global growth has shifted since summer 2006 in geographical terms. The United States has been experiencing a soft landing since the middle of last year, under the influence of the housing market downturn, which will probably continue to act as a drag on the economy for much of 2007. Eurozone growth (year-on-year) overtook the United States at the end of 2006, indicating a decoupling of the two regions.

Moreover global growth at the end of 2006 has been depending more on consumption of services and housing demand (with the exception of the United States in the latter case), while industrial activity and trade have slowed significantly.

The slowdown in US domestic demand and falling oil prices have lowered inflationary pressures, notably in the United States. Indeed, financial markets consider that the cycle of interest rate rises has probably come to an end in the USA and could be close to ending in the eurozone.

The "decoupling" of the eurozone from the United States might come to an end, as fiscal tightening together with the delayed impact of rising interest rates and slacker world trade as a result of the American slowdown are likely to weigh on European growth.

In 2008, as the main negative forces at work in 2007 in the main regions (US housing slowdown and fiscal tightening in the eurozone) fade, growth would likely go back to its potential rate without stoking inflationary pressures, and global trade would pick up once more.