Trésor-Economics No. 4 - Census of French companies’ establishments abroad

French companies' establishments abroad generated turnover in excess of € 520 billion in 2004, thus exceeding French exports, which totalled 340 billion. A census of these establishments conducted by the French Treasury (DGTPE) reveals a number of pathbreaking observations:

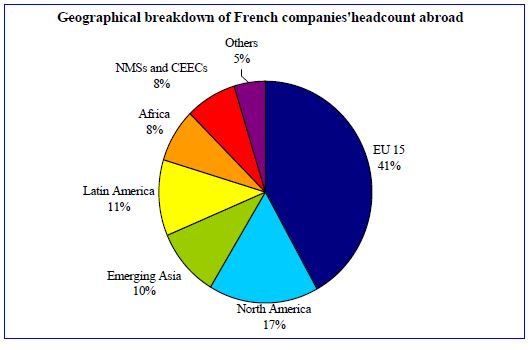

As far as the geographic structure is concerned, thecharacteristics are similar to those of French exports. French companies are more heavily involved than German firms in Africa and the Middle East, and less in Asia and the CEECs. In that sense, French companies are less well positioned than those of Germany.

Emerging market countries and developing countries host a substantial share of French activities abroad even though they represent less than 10% of capital invested. Further, in recent years French activities have grown fastest in the countries of Central and Eastern Europe (CEECs) and in Asian emerging countries.

Unlike what suggests Foreign Direct Investment data, French activity abroad is split roughly evenly between industry and services, each representing 40% of French establishments abroad and capital invested. The industrial sector is indeed larger than services in terms of the French companies' headcount and turnover abroad.

French companies' establishments in emerging market and developing countries are often located there in order to win new markets. In these countries, as in the developed countries, trade and service activities are substantial employers, respectively employing more than 20% and more than 30% of the French companies' headcount. Yet the majority of the service activities in the emerging market countries and developing countries is primarily directed towards serving local demand.