Trésor-Economics No. 1 - The global economic outlook in autumn 2006

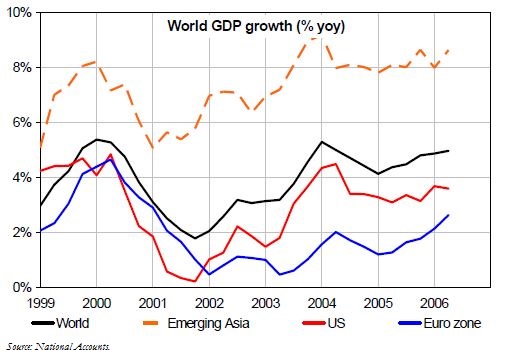

Growth in the global economy in the first half of 2006 was geographically better balanced than previously: it remained very robust in the emerging countries of Asia, while the euro zone enjoyed a strong domestic demand-led rebound. Growth slackened in both the United States and Japan in the second quarter.

Looking ahead, global growth is expected to slow in 2007. Less accommodating monetary policies designed to combat inflationary pressures are raising the cost of debt, in particular household debt. Until now, lending had helped counteract the negative effects on domestic demand of dearer oil (up 100% since 2003). Looking ahead, assuming by convention that the price of oil remains stable, persistently high energy prices will continue to hold back growth in 2007.

In addition to these global factors, for the American economy the housing market slowdown will weigh on residential investment and consumption (via the wealth effect and declining mortgage equity withdrawal volumes). In the euro zone, Germany and Italy will have to continue to make substantial efforts to cut their public deficits. However, European companies are in strong financial health, and this will help to sustain investment and limit the slowdown in the euro zone. Growth in 2007 will be below potential in the United States, and very slightly so in the euro zone. Now that it has put deflation behind it, Japan will again be carried along by its own dynamic and enjoy above potential growth.

There will be no deterioration in the global imbalances, i.e. the US current account deficit, Asia's and the oil exporters' surpluses, but these will remain substantial. The risk of a brutal adjustment of exchange rates and risk premiums cannot be ruled out.