Counter-cyclical unemployment insurance: why?

According to INSEE, in the 4th quarter of 2022, 62% of companies in services (excluding transport), 65% in manufacturing and 81% in construction were still reporting hiring constraints. These are the highest levels ever recorded. Conversely, supply chains disruptions were on the decline. This diagnosis has been confirmed by the Banque de France survey in January 2023.

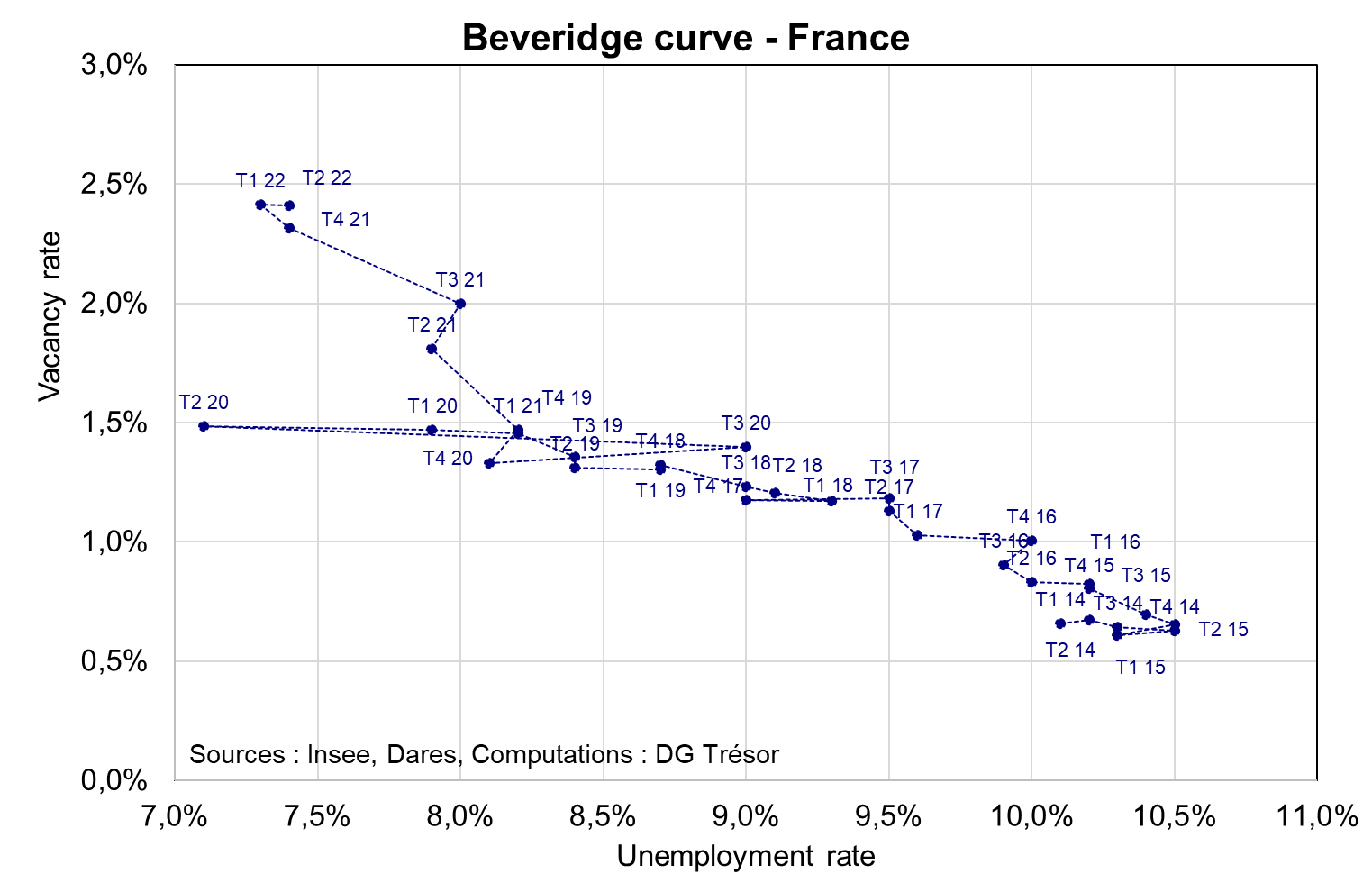

The decline in the unemployment rate over the years 2021 and 2022 (about -1 percentage point between 2021Q1 and 2022Q3, or about 200,000 fewer ILO unemployed over the period) shows that companies have been able to fill many vacancies with previously unemployed people. Over a longer period, the almost continuous decline in the unemployment rate since 2015 has been accompanied by a relatively modest increase in the proportion of job vacancies (Figure 1). However, with 7.3% unemployment (2022Q3 figure), we have reached a point where the increase in the proportion of job vacancies is no longer accompanied by a significant fall in unemployment: the Beveridge curve, which links the unemployment rate to the job vacancy rate, has become much steeper in France.

Figure 1

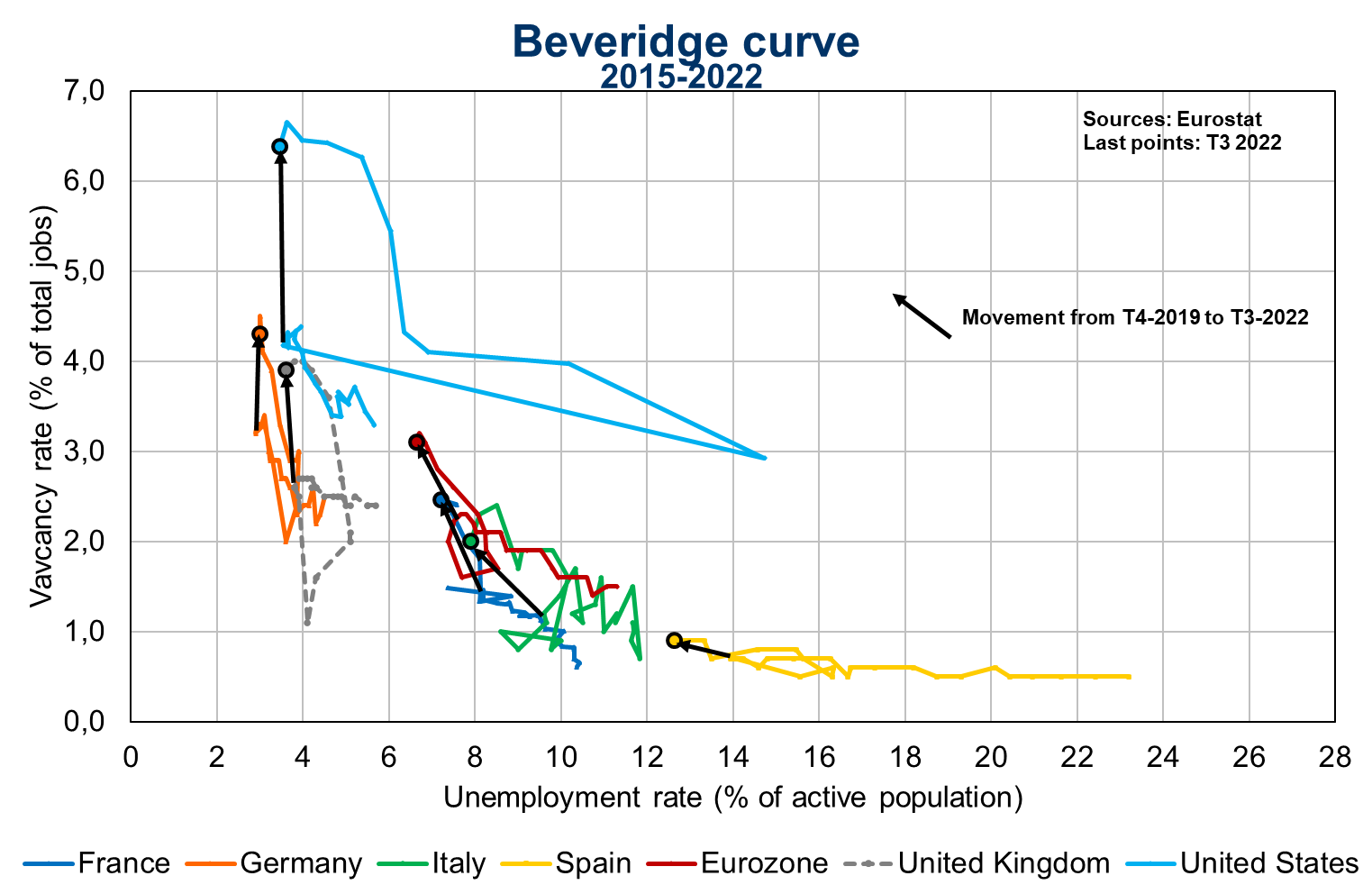

However, there is no real reason to leave it there. If we zoom out again by juxtaposing the Beveridge curves of different advanced countries, we can see that the unemployment rate below which the job vacancy rate increases is rather around 3-4% in Germany, the United Kingdom or the United States (Figure 2).

Figure 2

Sources : INSEE, Dares, Eurostat. DG Treasury calculations.

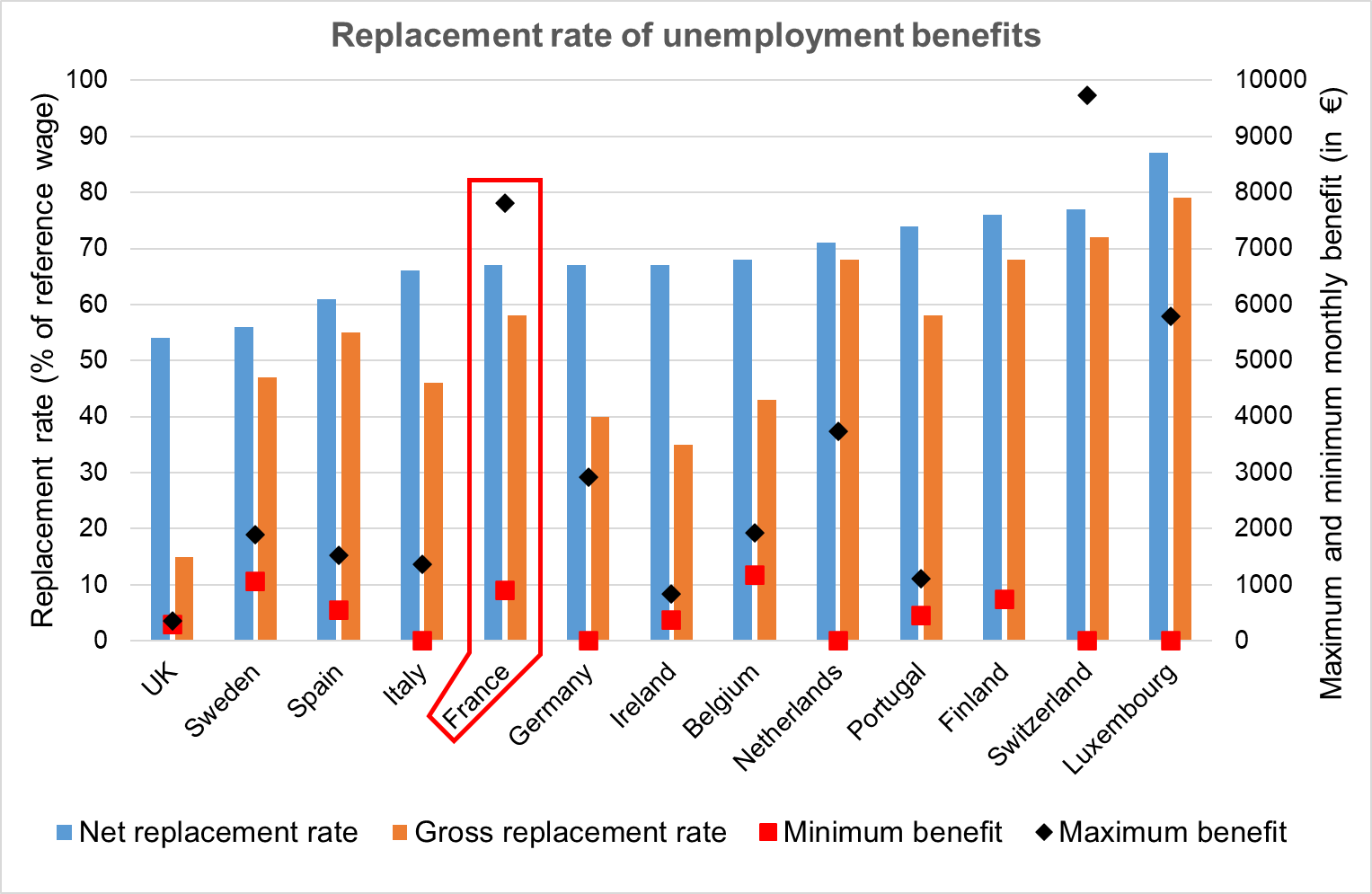

The premature steepening of the Beveridge curve in France betrays a relative inefficient matching process on the labour market: some unemployed people are unable to find a job while, at the same time, some employers cannot find the labour they need. Part of this mismatch between supply and demand is structural: the skills and geographical constraints of job seekers are not necessarily in line with the demand of the firms, at least in the short term. However, existing research also points to the role of the unemployment insurance system. In France, it provides benefits for up to 2 years before the age of 53 and 3 years from the age of 55, a relatively long period in international comparison (Figure 3).

Figure 3: Maximum duration of unemployment benefit in some European countries

Source: Panorama des systèmes d'assurance chômage en Europe, Unédic, January 2022; L'assurance chômage en Europe - Etude de 15 pays, Unédic, July 2019; "L'indemnisation du chômage en Suisse", Unédic, 2014; "L'indemnisation du chômage en Allemagne", Unédic, 2019; Agence pour le développement de l'emploi (ADEM) du Luxembourg; "L'indemnisation du chômage en Finlande", Unédic, June 2022; European Commission – Unemployment benefits in Portugal.

Incentives of the insured

Whatever its purpose (housing, automobile, occupational risks, illness, unemployment), the purpose of insurance is to protect an individual or an organisation against a risk. This protection comes up against the well-known problem of moral hazard: being insured modifies the behaviour of the individual or organisation. Insurers have developed strategies to protect themselves against moral hazard. For example, they impose a malus on drivers after an accident; they require security equipment from their policyholders (armoured doors); or they carry out random checks, for example on people who are off sick.

In the case of unemployment, the temporal limit of the benefit is the main mechanism to limit moral hazard, by encouraging the return to work, especially when the date of termination of the benefit is approaching. This mechanism has been empirically corroborated by Marinescu and Skandalis (2021) on the French case. Using a sample of 500,000 jobseekers who became unemployed between 2013 and 2017, the two researchers show that job search effort (measured by applications sent via an online platform) increases by 50% in the year preceding the end of the benefit. Therefore, a shortening of the benefit period would be likely to reduce the unemployment period. Also using French data, Le Barbanchon, Rathelot and Roulet (2019) estimate that a 10% shortening of the potential benefit period reduces the actual unemployment benefit period by an average of 3%, a figure comparable to that obtained in other European countries (see Roulet, 2018). According to the same studies, the time to return to work is reduced by 1% following a 10% reduction in the potential duration of benefits.

However, one can wonder whether a shorter benefit period could deteriorate the quality of the job found after the unemployment period, as the insured person would be encouraged to accept a job that is not in line with his or her qualifications and aspirations. Employers could also take advantage of this rush by offering lower wages. Although the economic literature is not unanimous on this point (Les droits rechargeables - UNÉDIC - October 2019), several studies carried out for France and other European countries highlight the negligible effects of extending the compensation period on the quality of employment: the wage recovered would not be higher, nor would the duration of employment (Le Barbanchon, 2016), the job would not be more stable (Fackler, Stegmaier and Weigt, 2019), the number of hours sought, the type of contract sought, or the maximum journey accepted between home and the workplace would not be affected either (Le Barbanchon, Rathelot and Roulet, 2019). In reality, two opposing effects seem to offset each other: on the one hand, an increase in the duration of compensation allows a form of selectivity on the part of jobseekers, and therefore access to a better job; on the other hand, a longer period spent unemployed reduces the prospects of hiring, which translates into a penalty on the quality of the job found.

Countercyclicality

When thinking about an optimal unemployment insurance system, one must also take into account the situation of the labour market, as shown by Landais, Michaillat and Saez (2018). If few firms are looking to recruit, a limited search effort by an unemployed person makes another more motivated unemployed person find a job more easily. Thus, when there are few vacancies in the market, the disincentive effects of insurance have limited impact on aggregate unemployment. Conversely, if, as is the case today, many companies are looking to recruit, then on the contrary, the job search of some does not affect the search of others, and unemployment decreases more rapidly when the search effort increases. Taking into account the situation of the labour market and its possible congestion, it is advisable to have a counter-cyclical unemployment insurance: more generous in the trough of the employment cycle, less so at the peak. Moreover, a countercyclical UI system better fulfils its insurance role, since it better protects the worker in periods when the probability of finding a job is low (Andersen, 2014).

In the United States and Canada, unemployment benefits increase in times of crisis and are paid for longer than in so-called "normal" times. In France, on the contrary, the parameters of unemployment insurance do not vary during the activity cycle. According to Cahuc, Carcillo and Landais, 2020, the compensation rules even tend to be slightly pro-cyclical. However, Schmieder, von Wachter and Bender (2012) show, on German data, that the disincentive effects of unemployment insurance to return to work are more limited during a recession, suggesting welfare gains associated with the countercyclical modulation of the potential duration of compensation.

Practical work

Should the potential duration of compensation, the amount of compensation (replacement rate) or the eligibility conditions be modulated? The choice has implications in terms of redistribution and incentives. In particular, modulating the replacement rate over the cycle could involve affecting financially constrained workers in troughs (Chetty, 2008). Conversely, modulating the potential duration of benefits via the conversion rate makes it possible to affect all workers, including those who have accumulated savings during their period of employment, and without any noticeable effect on the quality of the job found (see above). A modulation of the maximum duration of compensation alone would have a slower effect and would risk penalising certain categories of unemployed more heavily (those with the longest entitlements). Finally, a modulation of the eligibility conditions would have effects that are difficult to control given the length of the period of employment and could deprive certain workers of their rights, in particular young people.

The second issue is the choice of the trigger variable. This variable must be able to reflect the labour market situation faced by a jobseeker in a quick, objective, understandable and robust way with respect to possible labour market developments. On the basis of these different criteria, the unemployment rate must be prefered to indicators of inflows and outflows from unemployment, the job vacancy rate and the output gap (between GDP and potential GDP). The unemployment rate is calculated by an independent institution - INSEE - based on an international definition given by the International Labour Office. It is little subject to revision, well known to the general public and its link to the labour market is clear to everyone.

Once the trigger variable has been chosen, it is necessary to find the appropriate thresholds. Decree No. 2023-33 of 26 January 2023, applicable from 1 February to 31 December 2023, provides for a 25% reduction in the potential duration of compensation when, for three consecutive quarters, the unemployment rate remains below 9% and does not vary by more than 0.8 percentage point quarter on quarter. An end-of-right supplement is granted when unemployment exceeds 9% during a quarter, or if the unemployment rate changes by more than 0.8 percentage point qoq. This second criterion is introduced in order to be able to react quickly to a sudden deterioration in the economic situation, even if the unemployment rate remains low, without triggering too frequent changes in the parameters of the UI system. The decree provides for a minimum duration of compensation of 6 months for eligible persons who have paid contributions for at least 6 months, which maintains the insurance function of the scheme for all eligible workers, even during the peak of the cycle, and allows for a good match on the labour market. The conditions of eligibility and the amount of the monthly allowance remain unchanged.

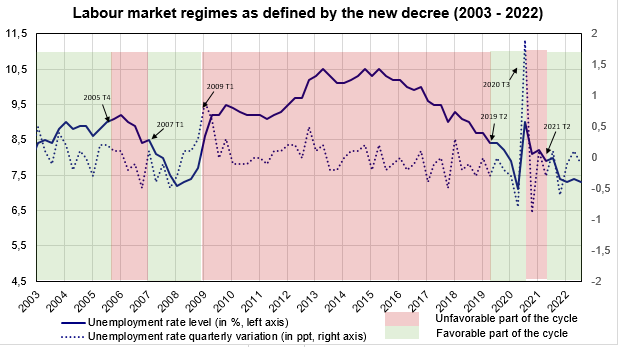

Figure 4 shows what the potential duration of benefits would have been over the period 2003-2022 if this modulation had been applied. The graph is in a green zone when the labour market situation is favourable and in a red zone when it is deteriorated. If the compensation rules contained in the decree had been in place since 2003, the unemployed would have had a top-up from the global crisis of 2009 until 2018 and again, briefly, in 2020. Thus, over twenty years, the combination of the two criteria (level and variation of the unemployment rate) would have made it possible to identify the two main crises, the 2009 crisis and the Covid crisis, and only these two episodes.

Figure 4

Reading: In 2018Q1, under the modulation rules introduced by the new decree, the cycle would have been considered unfavourable: the unemployment rate was above 9%. In 2019Q2, it would have been considered favourable because of the prolonged fall in unemployment to below 9% (with no quarterly change of more than 0.8 percentage points over the period). From 2020Q3 onwards, it would have been considered unfavourable again for three quarters, due to the sudden increase in the unemployment rate in 2020Q2.

Source: DG Treasury, based on INSEE data.

Hence, the decree fulfils the specifications set out in the academic literature, bringing the French scheme closer to the "optimal" trade-off between insurance and incentives, which varies over the cycle. Modulation according to a clear rule gives visibility to workers and will allow balancing the benefit system over the cycle, contributing both to macroeconomic stabilisation and to the sustainability of public finances. Maximising employment at the top of the cycle also responds to the needs of the firms. In addition to UI contributions, the wealth created will provide tax resources for the general government.

Read more:

>> Version française : Assurance-chômage contra-cyclique : pourquoi ?

>> All posts by Agnès Bénassy-Quéré, chief economist - French Treasury