Growth at the end of the tunnel

Beyond the fog

Economists are routinely debunked for their forecasts which generally prove to be wrong, especially in times of turbulence. It would be wise not to make any forecast. As a matter of fact, and contrary to popular belief, most economists are not in the business of forecasting. This was the case with me until recently.

However, the very purpose of macroeconomic policies is to stabilize the economy: they need to tighten when the economy is booming, and to loosen in times of crisis as it is the case today. To at least try to be counter-cyclical, monetary and fiscal policies need to rely on assumptions about the economic outlook.

Furthermore, the diagnosis about the state of public finances depends fundamentally on this outlook. Tax revenues are more or less proportional to GDP, so the tax-to-GDP ratio is not much dependent on the economy: in the event of a crisis, tax revenues fall but they stay more or less stable in percent of GDP. In contrast, public spending hardly reacts spontaneously to changes in GDP. In France, public spending represents around half of GDP. If the latter decreases by 10% in 2020, as the Government anticipates today, the deficit will automatically increase by 5% of GDP. Such huge deficit is not worrying as long as it is a one-off, and given that financial markets are willing to lend the corresponding amounts. However, members of Parliament must be properly informed.

Compared to the projection made in June for the Budget Orientation Debate, the government's new forecast for 2020 and 2021 takes into account three novel elements:

- The relatively strong rebound in activity during the summer in France, and therefore a better than expected first semester;

- The resurgence of the epidemic in France and in other European countries, which could curb consumption and output over the second semester, before gradual normalization in 2021;

- The recovery plan announced on September 3, of which some measures (hiring bonus for example) are already in place, and which could raise the level of GDP by around 1 ½ percentage point in 2021 compared to a scenario without a recovery plan.

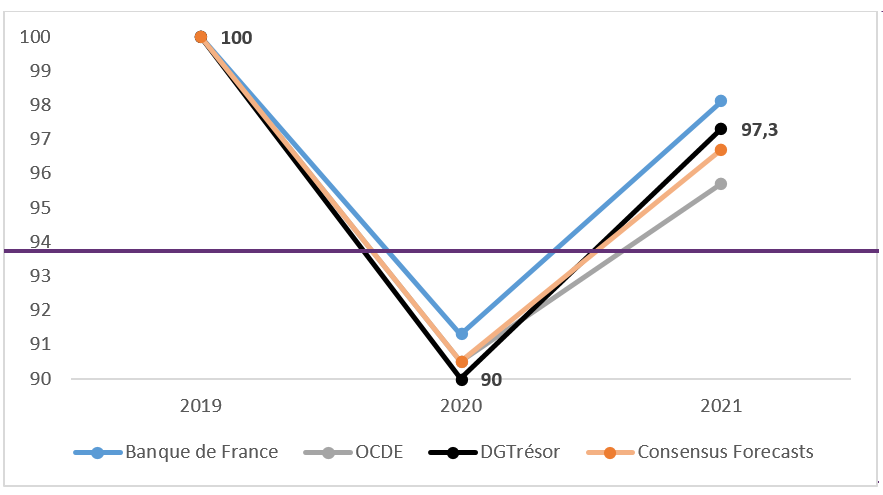

The combination of these three elements leads to forecast a 10% decline in GDP in 2020, followed by an 8% rebound 2021. In 2021, GDP would lie 2.7% below its 2019 level. Beyond their forecasts for the 2020 dip and the 2021 rebound, the most recent forecasts for France all place 2021 GDP between 2 and 4 percent below its 2019 level (Fig. 1).

Figure 1. GDP path, September 2020 forecasts

(index 100 in 2019)

Sources: Banque de France, Consensus Forecasts, OECD & French Treasury, September 2020.

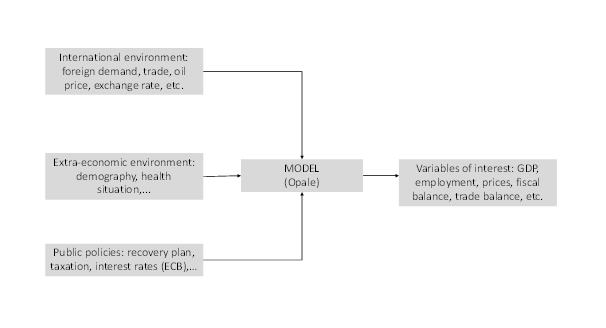

Any economic projection exercise is based on a macroeconomic model (Opale, in the case of the French Treasury) in which a series of assumptions are injected on (1) the international environment (growth of the other countries, world trade, oil price, exchange rate, etc.), (2) the extra-economic national context (demography, health situation, climate change, etc.) and (3) public policies (Fig. 2). Usually, the uncertainties mainly come from the international context and from the behavior of households and firms. Today, though, all projections are heavily dependent on the very uncertain evolution of the epidemic, on how private agents (firms and households) and public ones (municipalities, universities, etc.) will adjust to this unprecedented situation and, finally, on how they will seize the various supportive schemes of the recovery plan.

FIgure 2. The making of forecasts

Recovery engines

The economic rebound in 2021 will rely on three drivers: household consumption, corporate investment and public investment.

Household consumption

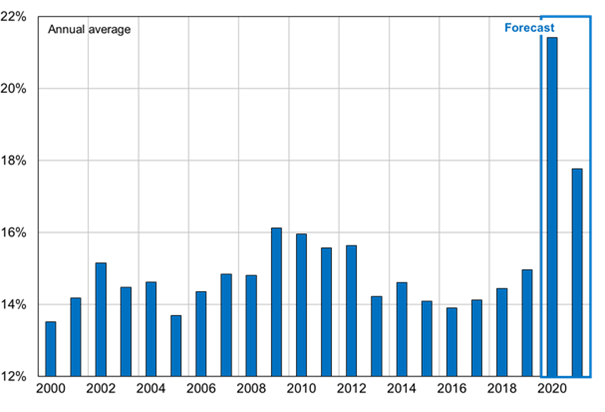

In 2020, household incomes were almost entirely preserved thanks to several support mechanisms, in particular short-time work. Given the constraints weighing on consumption during the lockdown, households as a whole have accumulated savings that could reach about €100 billion by the end of the year. In fact, the household savings rate (ratio between savings and disposable income) jumped during lockdown, from 15% in Q4 2019 to 27% in Q2 2020 (INSEE). Over the year, the savings rate could stand at 21%, before dropping to 17-18% in 2021. The savings rate would therefore remain above its pre-crisis level due to precautionary behaviors related to the still uncertain health situation and to the deterioration of the labor market relative to 2019. For the same reason, household investment (particularly in housing) should remain below its 2019 level.

Figure 3. Household savings rate

(in % of disposable income)

Sources: Insee, French Treasury (September 2020).

Corporate investment

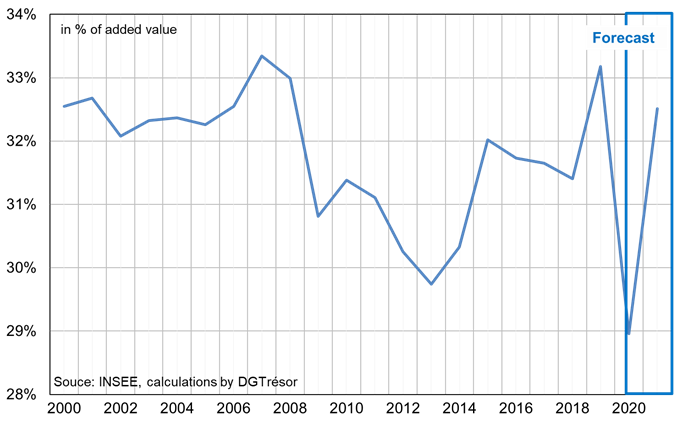

In 2020, firms were severely hit by the health crisis. Over the first two quarters, their markups (the ratio between gross operating surplus and value added) fell by more than 7 percentage points for non-financial corporations (Insee). Over the year as a whole, the markups for non-financial firms would decline by 4 pp relative to 2019. This decrease, which includes 1.3 pp due to the impact of the scrapping of the CICE (replaced since 2019 by social security cuts), appears relatively contained in view of the economic shock , and is achieved thanks to the numerous public support measures, notably short-time work. Not surprisingly, investment fell sharply in the first semester. Over the year as a whole, the fall in the corporate investment rate (the ratio of gross investment to value added) would be limited to only 1 percentage point as a result of the simultaneous, dramatic drop in both the numerator (investment) and the denominator (value added).

In 2021, a sharp rebound of markups can be anticipated, notably as a result of the recovery plan (in particular the cut in production taxes). The recovery of markups, combined with dynamic demand and equity injections (allowing fragile companies to repair their balance sheets) will support corporate investment.

Figure 4. Markup rate of non-financial corporations

(in % of added value)

Sources : Insee, French Treasury (September 2020).

Public investment

Public investment decreased during the first semester of 2020. This evolution is not only due to the crisis, but also to the local electoral cycle, since public investment is largely decided at municipal level and is traditionally low in election years. Over the year as a whole, however, public investment should decline much less than corporate and household investment, already playing a stabilizing role in the sinking economy. The recovery plan would contribute to a recovery of public investment by more than 9% in 2021.

This macroeconomic scenario, on which the 2021 budget will be based, will be detailed in the Economic, Social and Financial Report which will be made public in early October.

Read more :

>> Version française : La croissance au bout du tunnel

>> All posts by Agnès Bénassy-Quéré, chief economist - French Treasury