Ex ante, ex post: tuning the two pillars of policy evaluation

Post by Agnès Bénassy-Quéré, chief economist of the French Treasury

My last post, on the simulation and analysis of firm-level data to inform policy-making during the crisis, did not give rise to any complaint. Still, it was describing how micro-simulations carried out at the beginning of the crisis, which anticipated a sharp increase in insolvencies, have been partly contradicted by the actual financial statements, which so far have evolved more favourably. Did the modellers underestimate the capacity of the economy to adapt? Or are the financial data for 2020 misleading? In short, should we give more credit to ex ante micro-simulations or to ex post accounting observation?

Even though year 2020 was marked by the pandemic and the emergency support granted to companies and households, we should not forget that technical progress, climatic hazards and changes in consumers’ preferences and behaviours were not put on hold. Thus, the simple comparison of the 2019 and 2020 financial statements of companies does not allow to conclude on the impact of the crisis nor on the impact of public support: it is an accounting observation rather than a genuine ex-post evaluation, which would require comparison with a counterfactual scenario without crisis and/or without public support.

Evaluation of the recovery plan

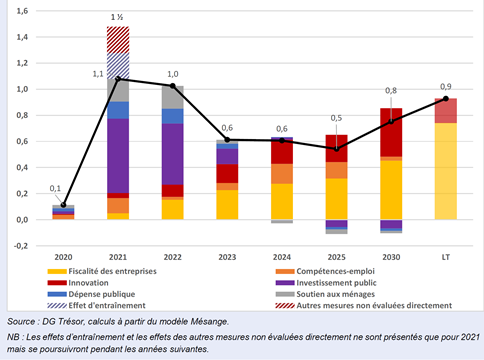

The evaluation of the recovery plan will lead to the same challenges. When it was designed, macroeconomic simulations using the French Treasury's neo-Keynesian model, Mésange, estimated its cumulative impact on GDP over the period 2020-2025 at +4%, excluding microeconomic effects and European spillovers (Figure 1). A Recovery Plan Evaluation Committee was then commissioned to evaluate the effective ex-post impact. This committee has just launched a series of calls for proposals to evaluate some flagship measures such as energy retrofitting of public and private buildings, the '1 young person = 1 solution' plan, etc. - but also to evaluate the plan as a whole. Considering the different measures altogether, and accounting for their interactions, what will have been the impact of the plan on GDP and employment compared to the natural rebound of the economy after the crisis?

Figure 1. Estimated impact of the recovery plan on GDP

(Difference in percent compared to a scenario without a recovery plan)

Source : Rapport Economique, Social et Financier 2021, October 2020. DG Trésor, calculations with the Mésange model.

Legend: yellow stands for company taxation; orange for skills and employment; red for innovation; purple for public investment; blue for other public spending; grey for household support; shaded blue for spillover effect; shaded red for other measures not directly assessed.

Interpretation: In 2022, the total impact of the recovery plan (compared to a scenario without the recovery plan), is evaluated at +1% on GDP.

N.B: The spillover effects and the effects of other measures not directly assessed are only presented for 2021 but will continue in subsequent years.

Ex post evaluation is unfortunately one of the areas where macroeconomics has the most room for improvement. The major difficulty is the counterfactual scenario, when the whole country is 'treated' by the recovery plan, rather than a sub-group of individuals or firms. One possibility is to compare the economic performance of the 'treated' country to that of one or more 'untreated' but similar countries. For example, Campos, Coricelli and Moretti (2019) estimate the impact of European integration on GDP per capita to be around +10% over a 10-year horizon. This method is ineffective for the recovery plan because all advanced countries have deployed similar plans simultaneously, all the more so in the European Union where the plans have been coordinated. Even if a control group could be identified abroad, it would still be difficult to disentangle the effect of the recovery plan from the effect of the support measures that preceded it (with an overlap in 2021) and the effect of the France 2030 investment plan that follows it, also with an overlap.

Pension reform

To illustrate these methodological difficulties, another example is a pension reform aiming at raising the retirement age (age of entitlement and/or duration of contribution required for eligibility to a full pension). A first approach consists in simulating a macroeconomic model in order to evaluate ex ante the impact of such a reform. In a standard neo-Keynesian model, an exogenous increase in the labour force (by raising the retirement age) leads to a short-term imbalance in the labour market, which is progressively resolved by a decline in real wages. Depending on the calibration of the model and on the assumptions made (notably on the replacement income for unemployed or inactive seniors compared to retirement pensions), the increase in employment and GDP may take a while. GDP may even fall in the short and medium term according to the simulations carried out by the OFCE for the High Council on the Financing of Social Protection (Haut conseil du financement de la protection sociale, HCFiPS), while the impact is positive but limited in the simulations carried out in 2016 by the French Treasury for the Pensions Advisory Council (Conseil d'orientation des retraites, COR).

However, one may question whether a neo-Keynesian model, designed to study demand-side policies, is adequate to assess the impact of supply-side measures such as an increase in the labour force. Some will prefer to rely on an overlapping generation model such as the International Monetary Fund's GIMF model, which allows for inter-temporal effects. In this type of model, an increase in the retirement age raises the level of GDP very quickly, without any short-term depressive effect. One reason is that a fraction of households anticipate that they will be able to work longer and thus earn more money. As a consequence, they reduce their savings rate, which increases consumption. However, such simulation remains an ex ante exercise, with no guarantee of being realistic given the many assumptions on which they are based.

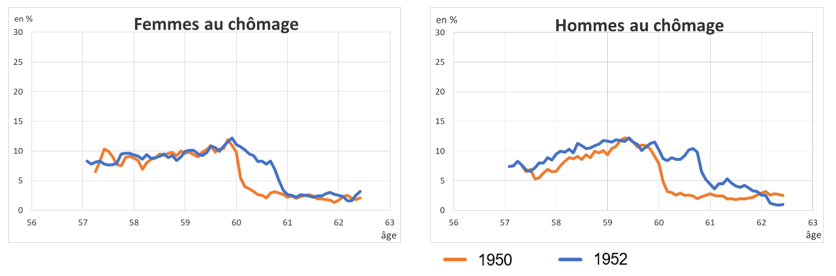

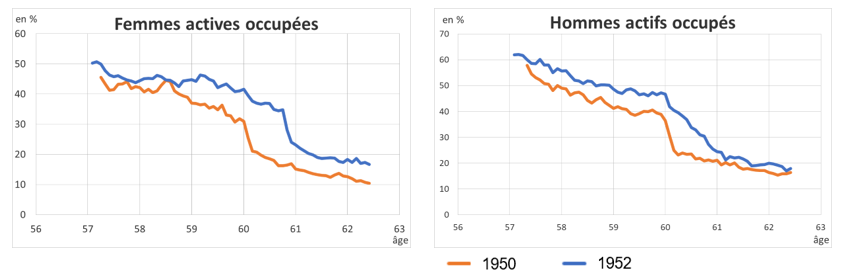

A completely different approach consists in analysing the impact of a similar reform such as the 2010 reform, which raised the age of entitlement from 60 for the 1950 generation to 62 for the 1955 generation. Dubois and Koubi (2017) and Rabaté and Rochut (2019) have studied the outcome for the generations affected by the reform compared to those immediately preceding them, over a relatively short time horizon. Their results indicate that the people affected by the reform have, on the whole, remained in the state they were in - employment, unemployment or inactivity. Mechanically, the reform increased the number of unemployed since some workers who would have been retired before the reform stayed longer in the labour market. However, the effect does not go beyond this mechanical shift, as shown in Figure 2: unemployment rates just follow the retirement age. In Figure 3, the employment rates increase at all ages but more specifically for the 60-61 year olds.

Figure 2. Share of 1950 and 1952 generations unemployed as they get older

On the left, the figure shows the share of unemployed women depending of their age. On the right, the figure shows the same chart for men.

Interpretation: Among women born in 1950, 10% were unemployed at 59 years and 9 months but only 4% at 60 years and 3 months. For women born in 1952, the proportions are 11% and 10% respectively.

Source: Dubois and Koubi (2017).

Figure 3. Share of 1950 and 1952 generations in employment as they get older

On the left, the figure shows the share of women in employment depending of their age. On the right, the figure shows the same chart for men.

Interpretation: Among women born in 1950, 33% were in employment at 59 years and 9 months and only 21% at 60 years and 3 months. For women born in 1952, the proportions are 42% and 37% respectively.

Source: Dubois and Koubi (2017).

This type of analysis does not take into account the possible substitution between workers of different age groups, and in particular between older and younger workers. This issue has been examined in different countries. Boeri, Garibaldi and Moen (2021) provide a recent estimate on Italian data, suggesting a limited substitution and rather with intermediate age groups. However, there does not seem to be a consensus on these substitution effects (see the review by Gruber, Milligan and Wise, 2009). When we take into account the reallocation of workers between firms, and therefore the labour market as a whole, we do not find much. Thus, Ben Salem, Blanchet, Bozio and Roger (2010) do not find any robust impact of the policies aiming at the withdrawal of senior workers from the labour market implemented before the 2000s on the professional integration of young people in France. For their part, Hairault, Langot and Sopraseuth (2009) highlight a positive effect of the increase in the retirement age on the employment rates of slightly younger workers, via a distance-to-retirement effect.

'Accounting' approach

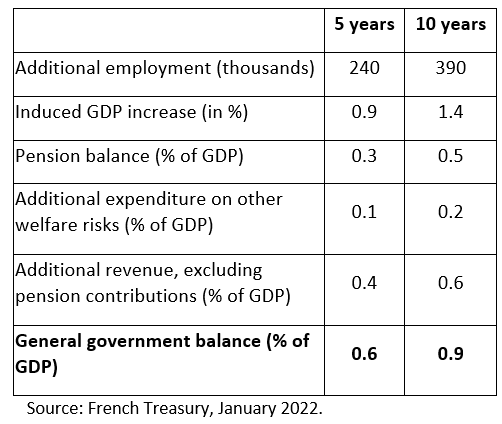

Building on these various studies, we can extrapolate the effects of the 2010 reform to a possible further increase in the age of entitlement to retirement, say by two years at a rate of one quarter per generation, using an 'accounting' approach. To do this, we observe the distribution by status - employment, unemployment, inactivity - of people aged 62 in 2019; then we apply these proportions to the future population aged 63 or 64, potentially affected by such a reform. This calculation leads to an estimate of 240,000 (after 5 years) and 390,000 (after 10 years) additional persons in employment. Assuming that capital adjusts, this 1.4% increase in employment at the 10 year horizon results in an additional GDP of 1.4% and, consequently, an increase in fiscal revenues of around 0.6 percent of GDP, which come on top of the 0.5 pp improvement in the pension balance that results directly from the reform at this horizon. We must then subtract the additional expenditure linked to the probability of 63-64 year olds being unemployed or inactive. According to Dares and Drees (statistics departments of the Labour and Health ministries), this cost is around 0.2 percent of GDP. This results in a net gain of almost one percent of GDP for public finances after 10 years (Table 1).

Table 1. Impact on the budget balance of a 2-year increase in the age of entitlement to pension (3 months per generation), 'accounting' approach

This approach ignores possible side effects on other categories of workers for which, as mentioned before, there is little solid evidence. It also assumes that the decrease of recruitments in constrained sectors (notably the public sector) is compensated by more dynamic hiring in other sectors. This assumption is reasonable in the light of the experience of the 2010 reform, which was nevertheless concomitant to a long economic crisis. It is even more reasonable in the view of current and future labour shortages, particularly in the key sectors of ecological, digital and demographic transitions. It nevertheless assumes a progressive adaptation of skills to the jobs offered.

While it is impossible to fully dissociate the effect on employment of the 2010 pension reform from that of the global and European crises, the mixed short-term impact of an age reform, highlighted by ex ante neo-Keynesian simulations, does not seem to be verified ex post. Perhaps these models underestimate the ability of the labour market to absorb additional senior workforce, for instance because they do not distinguish between different age groups, or because they underestimate the speed of adjustment of the productive capital stock. Or else, these models are estimated over a somewhat earlier period when the economy was less flexible. Or, maybe these models do not take into account any expectation effect that may be favourable to consumption and activity in the short term. In any case, the experience of the 2010 reform is rather reassuring regarding the capacity of the French economy to absorb a positive shock to the labour force, especially in a period of labour shortage.

***

Read more:

>> Version française: Ex ante, ex post : les deux jambes pas toujours raccord de l’évaluation

>> All posts by Agnès Bénassy-Quéré, chief economist - French Treasury