A good read for the summer: the National Recovery and Resilience Plan!

Green light! On July 13th, the European Council approved France's National Recovery and Resilience Plan (NRRP), which will enable our country to receive €40bn of European funding as part of the Recovery and Resilience Facility, financed by the "NextGenerationEU" joint loan.

For the fanatics, I highly recommend the 815 pages of the French NRRP, which describe in detail how European funding will contribute to a higher, greener and more digitalised economic growth in France. Once you’re done reading the French NRRP, feel free to dive into the German, Italian, Spanish, etc. plans. At this stage, 24 Member States have submitted their NRRP: all of them except for the Netherlands, Bulgaria and Malta.

First reading

There are several ways to look at NRRPs. First, following, Darvas and Tagliapietra (2021), one can compare the volumes of investment, especially those related to the European priorities - greening the economy (minimum 37% of investments) and digital (minimum 20%). Useful from a macroeconomic point of view, this first approach is more complex than it seems, for several reasons.

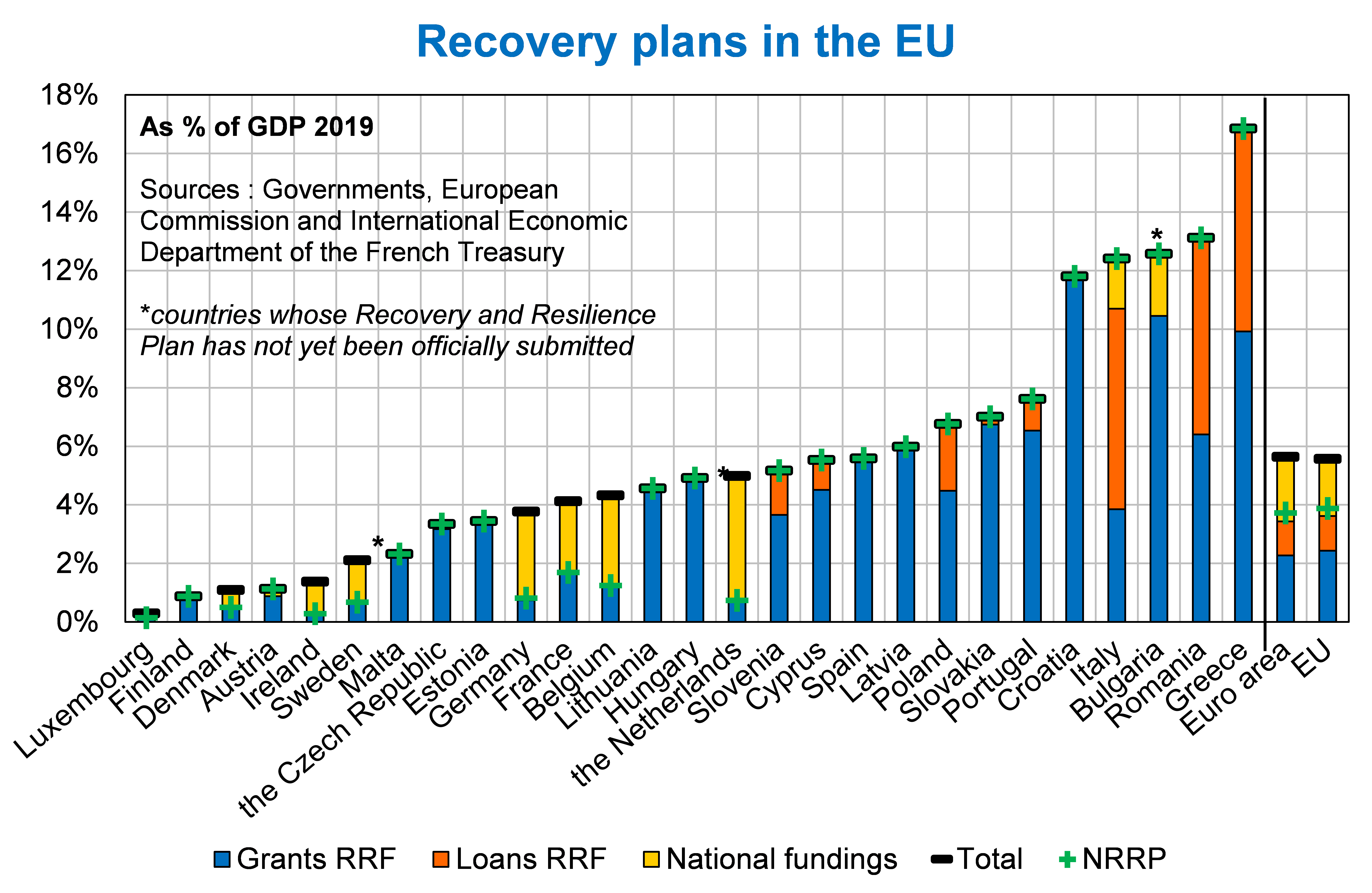

First, some national stimulus packages - notably in Germany, France and Belgium - are financed in part by national resources, which come on top of European grants. Others, notably Italy, Greece and Romania, have requested European loans in addition to grants. The macroeconomic impact of the plans and their distribution by priority must then be assessed taking into account all those dimensions, including the national components (Figure 1).

Figure 1

Note: Amounts excluding Multiannual Financial Framework and REACT-EU funds. For the three Member States that did not submit their NRRP, the amount shown is the one they should receive according to the expected distribution of the Recovery and Resilience Facility.

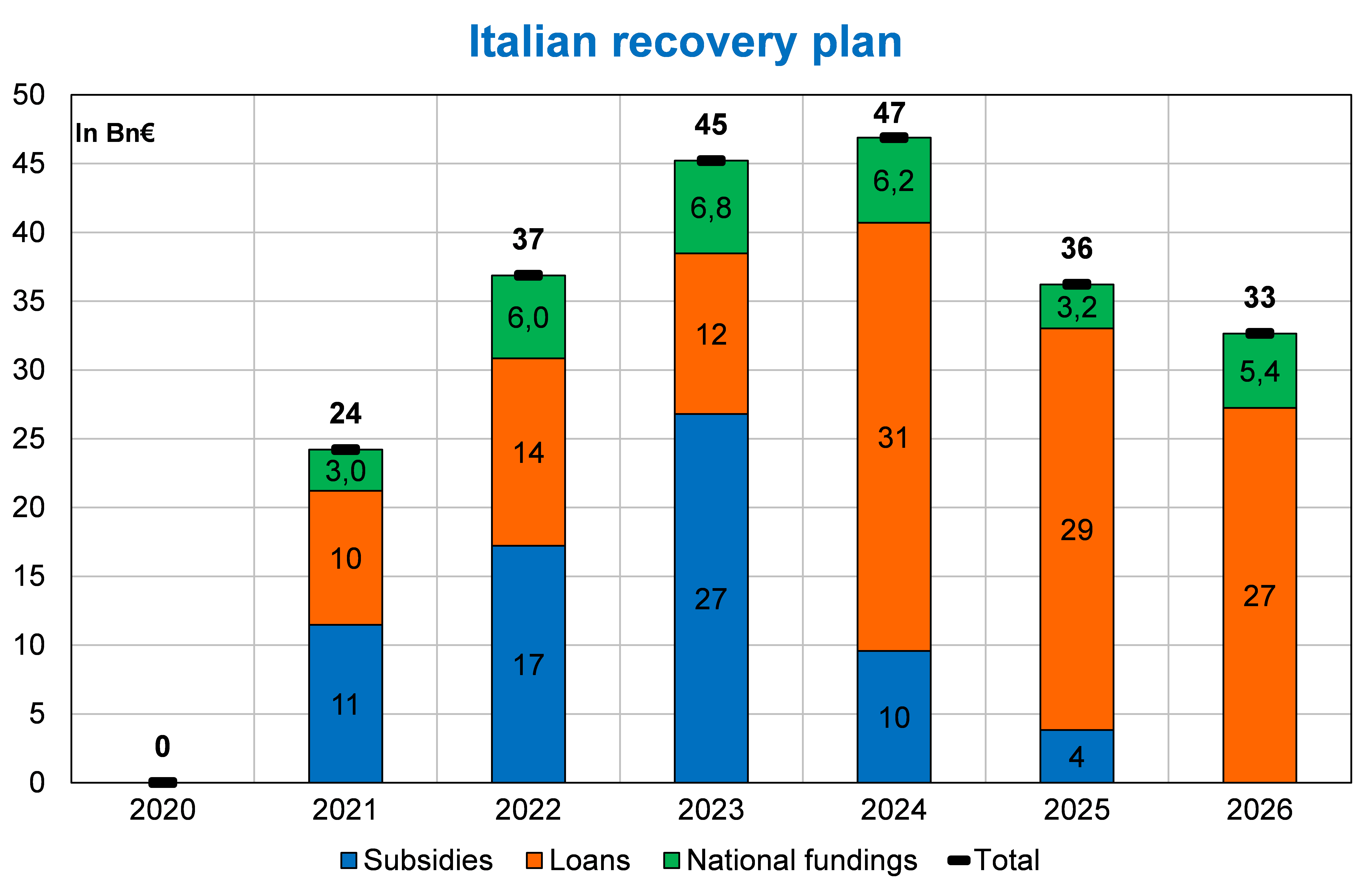

Second, the different stimulus packages do not all cover the same period. In both Germany and France, stimulus measures are concentrated on the period 2021 to 2023 and are pre-financed at national level before being gradually reimbursed from European funds up to 2026. Conversely, Spain and Italy are expected to spread their investments out to 2026, mainly using the loan component of the RRF (see the case of Italy in Figure 2). Romania and Slovakia have even announced stimulus spending until 2030.

Figure 2

Source: Italian Stability Program, April 2021. Measures are accounted for using national accounts methodology which tracks the year expenditure took place; European instalment corresponding to these expenditures comes in with a delay.

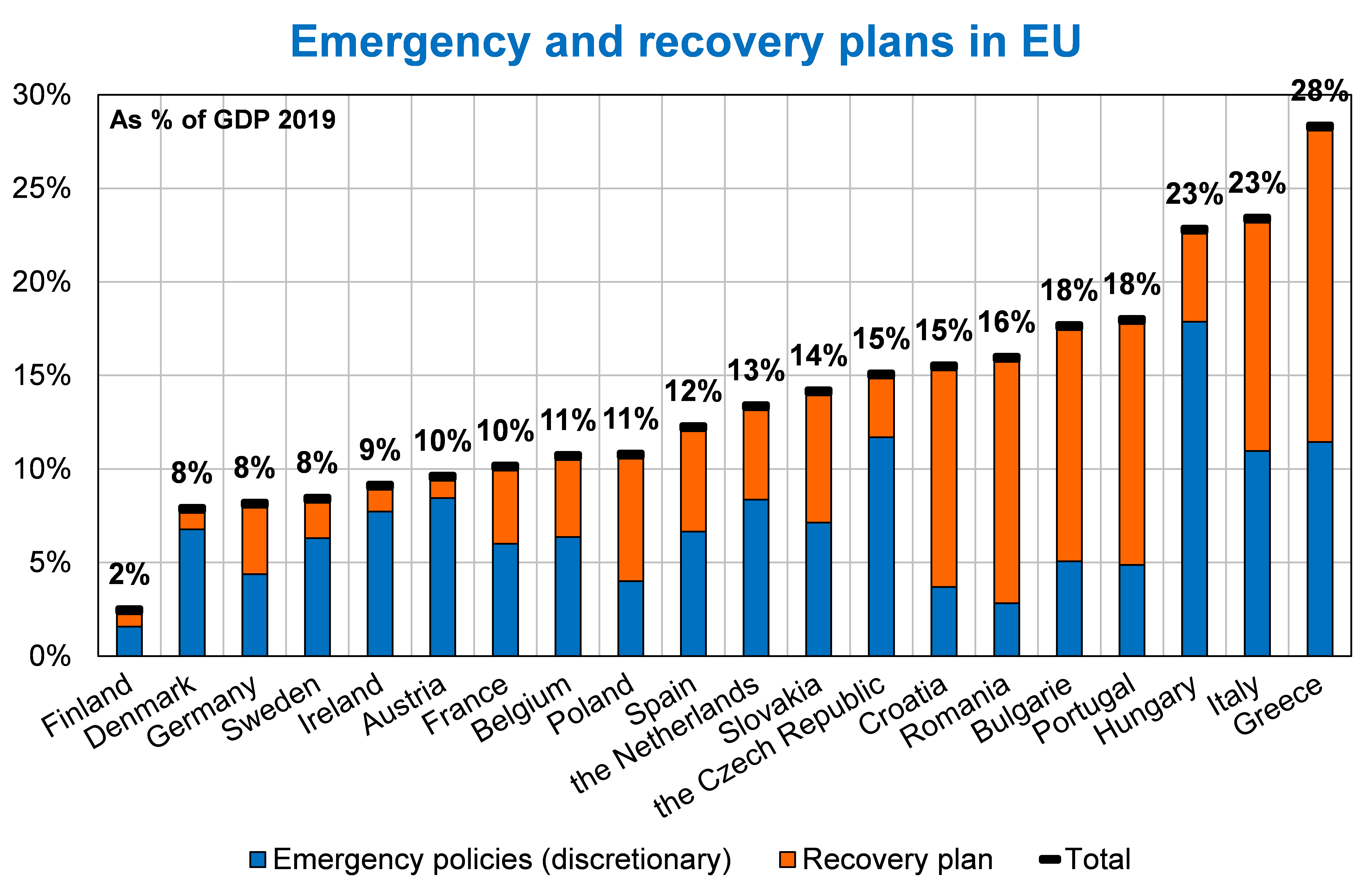

Third, the distinction between emergency measures (during the crisis) and recovery measures (after the crisis) is not always clear. In both France and Germany, recovery programs were designed during the summer of 2020. They have been implemented while unexpected new health restrictions had to be imposed and have de facto supported firms and households during these difficult periods. It is therefore tempting to add the two types of measures together (Figure 3).

Figure 3

Sources: NRRP and national budget documents, French Treasury computations.

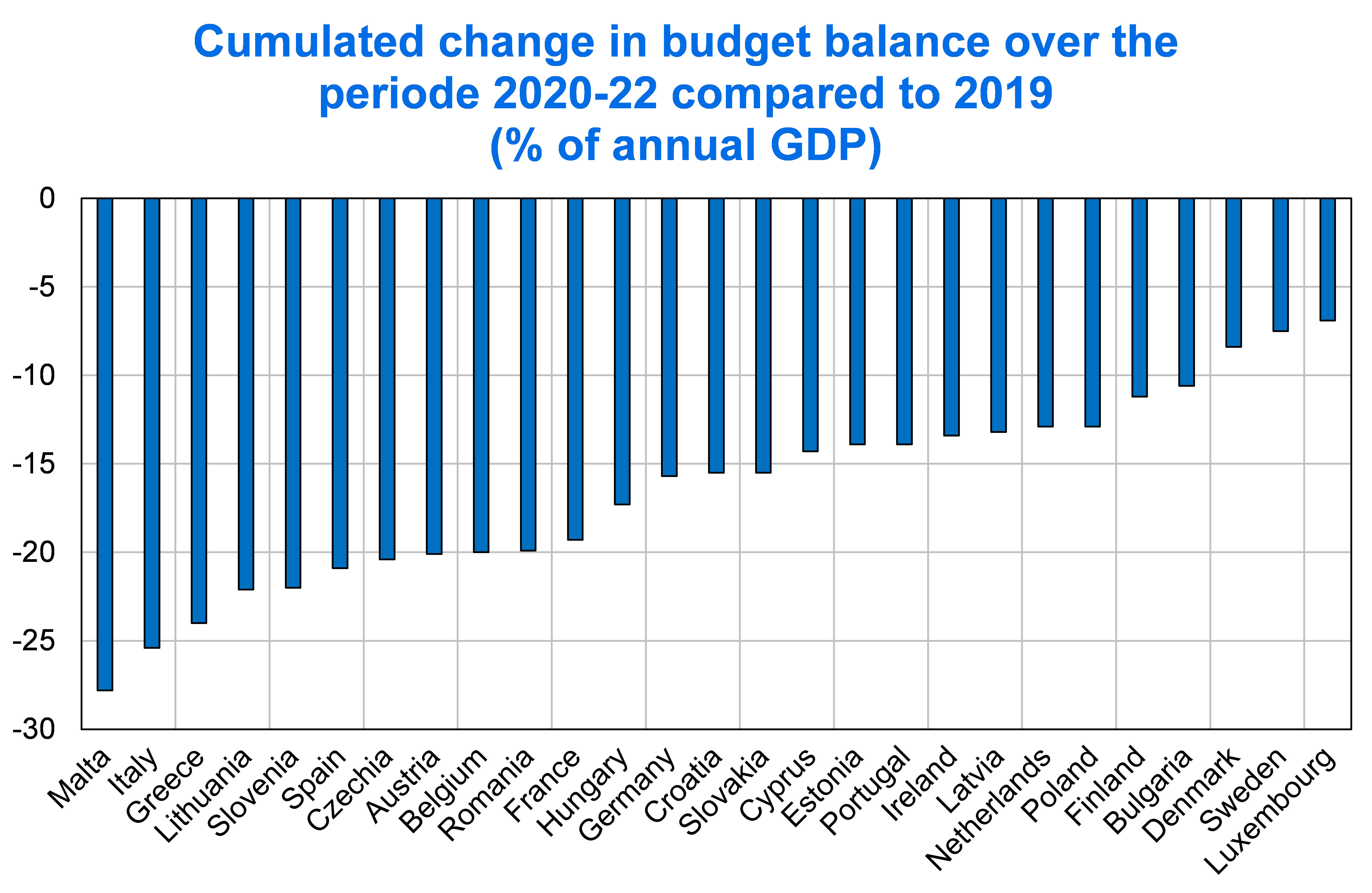

Finally, a comprehensive macroeconomic approach must also take into account the automatic stabilizers, which differ across Member States. For example, one can add up the additional deficits in 2020, 2021 and 2022 compared to 2019 (Figure 4), which mechanically feeds in higher public debt. According to this last metric, the cumulative effect of support and stimulus measures reaches nearly 20% of GDP for France, compared with 10% in the previous chart (discretionary measures only) and 4% in Figure 1 (discretionary measures of the recovery plan only).

Figure 4

Sources: Ameco, French Treasury computations.

However, the latter representation is still unsatisfactory. Not only is the cumulative variation in public balances endogenous to the severity of the crisis, but also and above all, NRRPs are intended to be long-term plans for transforming economies. The planned investments are not "simply" billions of euros injected into the economies, but they are also targeted public interventions aiming at raising the pace of potential growth and making the necessary transformation to face challenges associated to climate change. These investments come with a program of structural reforms that cannot be overlooked. Let’s start over.

Second reading

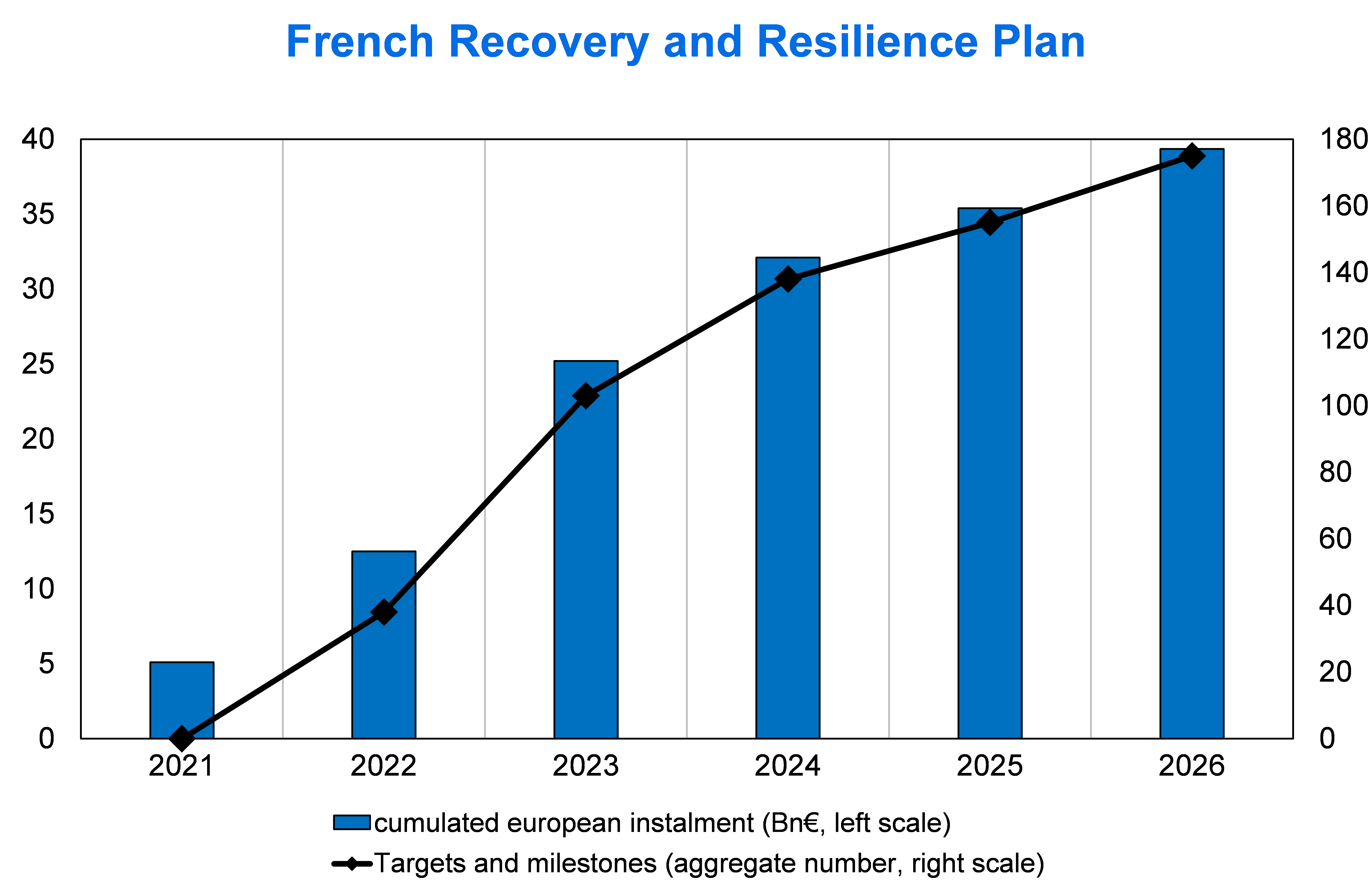

The French NRRP is presented as a succession of nine "components": energy renovation, ecology-biodiversity, green infrastructure-mobility, green energy-technologies, business financing, etc. For each component, the plan specifies "targets" and "milestones" - intermediate objectives that will trigger instalment from the European Commission according to a precise timetable. These targets and milestones may relate to investments or reforms. For example, the component entitled "Job preservation, youth, disability, vocational training" includes numerous investments in vocational training, support and hiring aids, but also reforms, notably that of unemployment insurance. Targets indicate quantitative objectives (e.g., 100,000 additional apprenticeship contracts by 2022), while milestones provide qualitative objectives (e.g., a first set of measures to reform the unemployment insurance scheme will come into effect in 2021, the remainder in 2022, provided economic activity is as good as hoped). The French NRRP includes more than 150 targets and milestones, 38 of which are to be achieved by 2021 (Figure 5).

Figure 5

Source: European Commission, Proposal for a Council Implementing Decision on the approval of the assessment of the Recovery and Resilience Plan for France. Should the targets for year N be assessed as completed the corresponding instalment is made in year N+1 (except for 2021 with a lump sum payment corresponding to 13% of the total amount of the plan). The 2022 instalment is expected after the 38 targets and milestones for the year 2021 are assessed as completed. The Commission has selected a total of 175 targets and milestones.

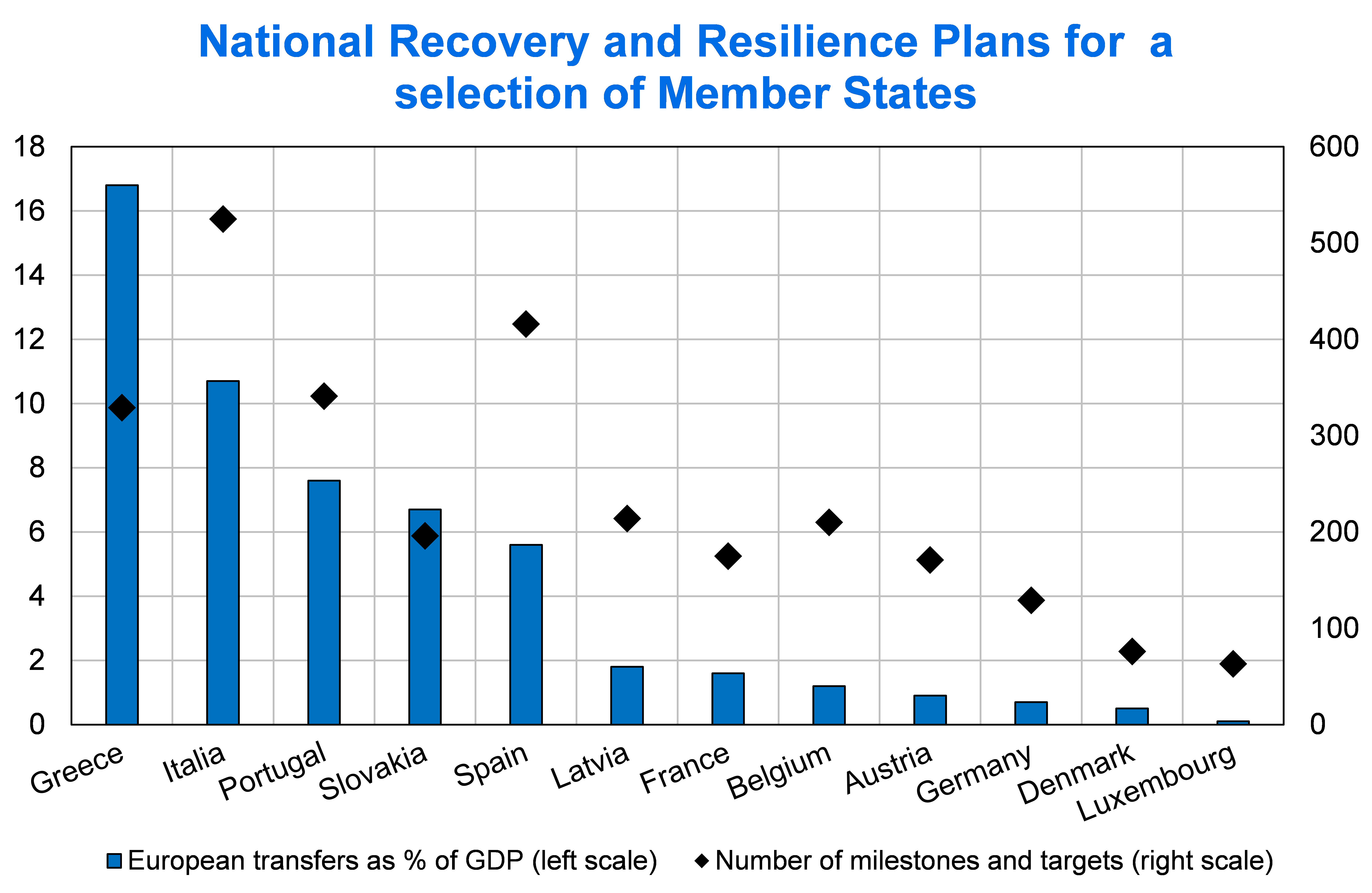

The reforms included in the NRRP are closely linked to the specific investments, to make them more effective. In some cases, they indirectly contribute to the effectiveness of the recovery plan by improving the medium-term fiscal outlook. Finally, as for every other Member states, France has to present reforms that also address the recommendations made by the European Union in the context of the European Semester. The number of reforms varies from one country to the next, but is generally higher in countries with the largest NGEU transfers as a percentage of GDP, Italy having a record of 508 of targets and milestones (Figure 6).

Figure 6

Source: NRRPs submitted, grants only.

At this point it is clear that the NRRPs are not Keynesian-style stimulus plans, but rather plans for the transformation and efficiency of European economies. There is much at stake for the European Union here. Indeed, we are talking about nothing less than the potential growth of the different countries (and therefore their capacity to bear high debts without risk of crisis), but also their capacity to face the challenges of ecological transition. Member states cannot disappoint their partners now that they have embarked on the path of common debt. Hence the tedious system of commitments and reporting set up. NRRP is also a good textbook to learn the concrete implications of issuing a common debt.

***

Read more :

>> Version française : Lecture estivale : le Plan National de Relance et de Résilience !

>> All posts by Agnès Bénassy-Quéré, chief economist - French Treasury