Supply and Demand, Season 2021

Supply and Demand: 2020 in retrospect

At the beginning of the health crisis, an intense discussion immediately unfolded amongst economists on whether the economic crisis to come would be mostly the result of a demand shock or of a supply shock. The administrative closures of theaters, restaurants or sports halls were both a supply shock (the services no longer being supplied) and a demand shock (banning the access to this type of establishment). However, for sectors that were still open, the proportion of the two types of shock could vary: school closures, supply-chain disruptions and the implementation of health protocols in companies would constitute a supply shock - a drop in productivity; but the fall in demand for goods and services linked to closed sectors (wine, taxis, etc.) could also be significant, sometimes even drammatic, and could be further aggravated by the fall in household and business incomes, as modelled by Guerrieri et al. (2020) et Baqaee et Farhi (2020).

Thus, it quickly became clear that it was necessary to use a sector by sector analysis, also taking into account the interactions between sectors: for instance, a closed restaurant reduces demand for laundry services, the latter also being subject to supply constraints (health protocols, closed schools, etc.). For France, Dauvin and Sampognaro (2021) have relied on the INSEE employment survey, the DARES Acemo-Covid survey, input-output tables and a model describing the interactions between the 17 broad sectors of the economy. After aggregating the results, they found that supply-side constraints (administrative closures, absenteeism due to school closures, supply disruptions) were responsible for about 2/3 of the 31% drop in activity recorded in France in April 2020, the remainder being attributable to the drop in final demand.

Biden, or endogenous supply

A year after this traumatic experience, the debate over supply and demand seems to have almost disappeared, under American influence. More precisely, it has been transformed. On its own, the $1.9 trillion stimulus package in the United States (9% of GDP, which follows the previous administration's stimulus package and precedes the investment plan and the one for families and education) greatly exceeds the output gap of the US economy, estimated at around 3 percentage points by the Congressional Budget Office. The rationale behind this is the following: by making the US economy overheat, the limits of production capacity will be pushed up: part of the inactive population will re-enter the labour market, workers will train to develop skills needed to respond to a shifted demand, companies will invest more, etc. Of course, inflation could temporarily increase, but this is a minor problem and even an advantage in a period when it is so low. Conversely, accepting even a transitory deficit in activity could involve lasting damage to the economy through more or less persistent hysteresis effects (see Blanchard, 2018 ; Fatás and Saxena, 2020).

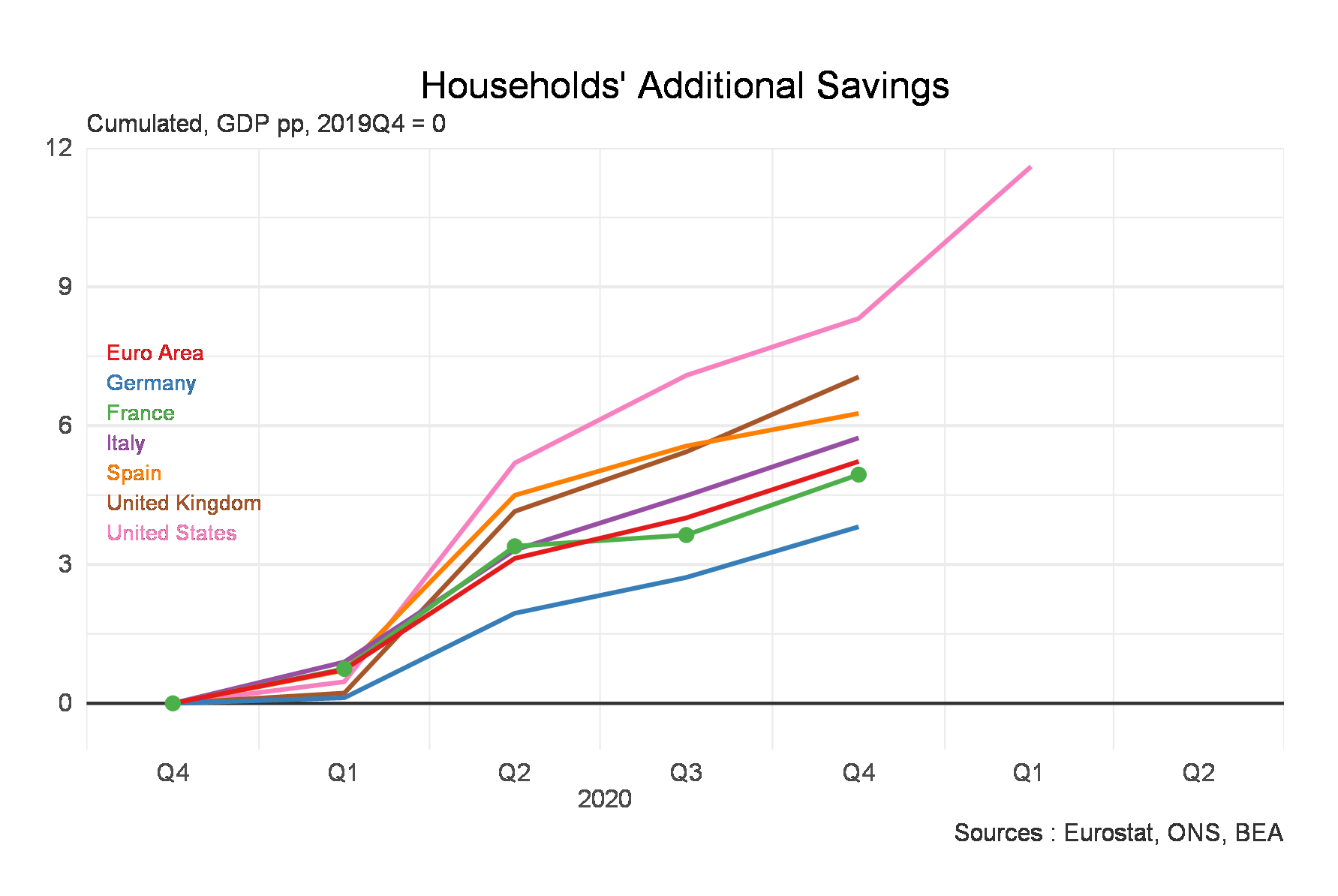

So why not do the same in France? Between 2019 and 2020, the French public deficit increased by around 7 GDP points ( if we correct for the double accounting of the CICE tax credit in 2019), while GDP decreased by about 8%. In the United States, the deficit increased by 9 points for a decline in activity of only 3.5%. Should France have done more? This is not obvious, given that the poorly targeted support measures in the United States have resulted in much greater increase in savings than in France (see Figure 1). The limited decline in employment in France (−1.5%, compared to −7.9% for GDP) does not seem to validate the need for more stimulus in the short run either. In 2009, employment fell by 2.2% while GDP fell by 3.8%. As we wrote in a previous blog post, public action in 2020 was devoted to preserving the production system (companies and workers) rather than to a Keynesian stimulus as such.

Figure 1: Cumulative increase in savings, difference to 2019 – GDP points

In 2021, the public balance should remain quasi stable both in France and in the United States, in percent of GDP. However, pre-crisis GDP will most likely be already recovered in the United States, unlike in France. Is the latter not stimulating enough? First of all, activity is still constrained by the pandemic in France, more than in the United States where health restrictions seem to have weighed less on the economy. Plus vaccination is also in the United States more than a month ahead of France. When parts of the activity are shut down, a boost in demand is unlikely to yield satisfactory results. However, vaccination is progressing and there is good hope that most of the constraints will be lifted by the summer. Why not follow the U.S. lead with additional and ambitious fiscal stimulus in the second half of the year? Could a strong rebound in demand drive an increase in potential GDP, so that there would be no significant supply constraints? The scenario is attractive, but two elements argue for some caution:

- France entered the crisis with still a high level of unemployment (7.8% in 2019Q4 for metropolitan France, against 3.5% in the United States); however, the pressures on production capacities, and in particular hiring difficulties, were significant (see Dares, 2020). France is a much more open economy than the United States: imports of goods and services account for 33% of GDP in France, compared with only 15% in the United States. Thus, while excess demand in the United States can result in a surge in inflation and/or a return to work of the inactive, in France, the most natural way to serve additional demand is through imports. Moreover, a price increase would be more problematic in France than in the United States as France is part of a monetary union: the resulting losses in competitiveness will not be recouped through currency depreciation.

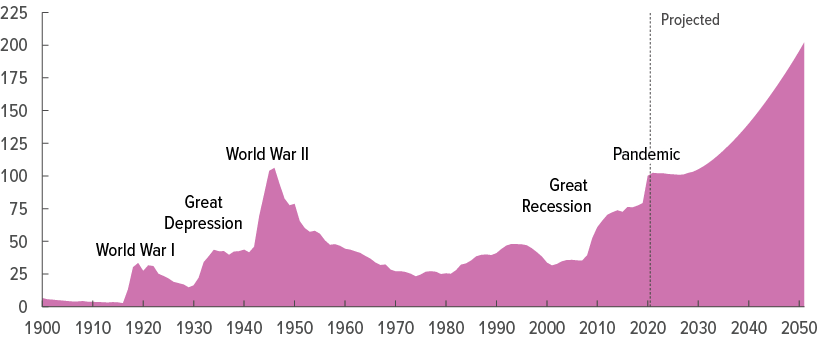

- Also due to its membership to the euro area, France cannot table a debt trajectory as the one foreseen by the CBO for the United States (see Figure 2). Indeed, the euro does not (yet) equal to the dollar as an international currency: demand for euro-denominated assets is not infinite; even if it were, debt divergence with respect to other Member States could shift market perceptions, not to mention the risk of infringing European fiscal rules. Finally, the record of France is not as good as that of other countries when it comes to reducing its debt ratio in good times. In short, France has to be more cautious than the United States when it comes to public finances, even though, like other countries, it is currently benefitting from historically low interest rates.

Figure 2: US federal debt in % of GDP

Source: Congressional Budget Office, March 2021.

Season 2021

The gradual lifting of health constraints in May-June 2021 is going to unlock demand: consumers will return to the terraces of bars and restaurants, go shopping, travel, etc. Some supply constraints (such as absenteeism for quarantine) will also decrease. Consumption may even surprise on the upside, as it was the case in the summer of 2020. Does this mean that supply can easily meet any rebound in demand, no matter how high? Although this is a possibility, several difficulties must be overcome (see Fernald and Li, 2021).

The first obstacle will be the residual health restrictions, in particular the gauges that may still affect the productivity of establishments open to the public: if only half of the seats are available in restaurants and theaters, productivity will mechanically be almost halved.

The second obstacle will be to adapt the supply to changes in demand. Let us imagine, for example, that tourism recovers but becomes more rural and less international. Since hotels and their staff cannot instantly move from the large cities to the Atlantic coast, the Alps or the countryside in Normandy, supply could prove in excess in some places and insufficient in others. More generally, the persistent nature of some effects of the crisis, notably the attrition of long-distance tourism, but also the digital transformation of the economy (the rise of e-commerce and teleworking) will require inter- and intra-industry reallocations that will take time to materialise. The average shopping basket of a European teleworker or holidaymaker may also be smaller than that of a commuting executive or a Chinese tourist.

The third obstacle will be the capacity to use production factors - capital and labor - immediately at the same level of productivity as before the crisis, after long months of reduced activity. The loss of field experience and capital maintenance, as well as the greater difficulty in integrating young people into companies during the crisis, could affect productivity during the first few months of the recovery. There are also delays in recruiting seasonal workers, but also regular employees who may have taken advantage of the months spent in partial activity to prepare for another future (Les Echos, 10 April 2021).

A flexible script

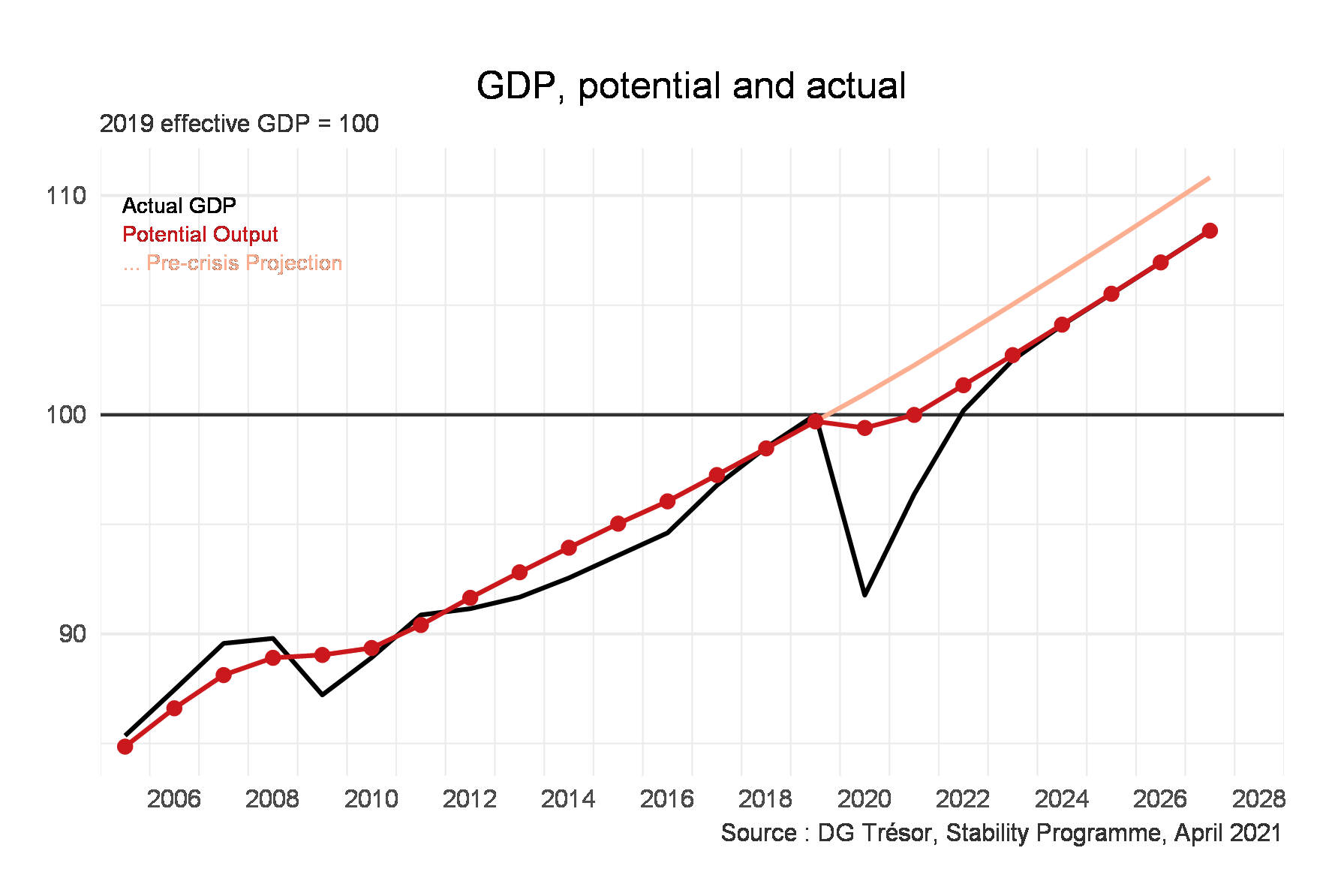

Like most forecasters, the French Treasury adopted a cautious and non-definitive view on potential GDP, with the assumption of a slightly lowered level (-2 ¼ %, see Figure 3). Under this framework, GDP would reach its potential by 2024, and any additional demand stimulus would have less and less effect on activity as GDP (black line) moves closer to its potential (red line).

Figure 3: Potential and effective GDP

However, this estimate of potential GDP is highly uncertain. It cannot be ruled out that, after this enormous but perfectly exogenous crisis, the pre-crisis path will remain unchanged (pink line); just as a lower potential GDP cannot be ruled out. Under such circumstances, the fiscal strategy should be to adapt government support to the demand and the supply according to the evolution of bottlenecks: to stimulate the demand in the absence of pressure on the supply side; or the supply in the opposite case, with the emphasis on training workers and restarting businesses, and possibly a granular approach depending on the industry or on the territory.

In times of great uncertainty, the economic policy response must be first and foremost flexible, attentive to an economy whose fragility may come from supply or demand, investment or consumption, industries or territories, households or companies, aggregates or inequalities, etc. As the economy gradually reopens, it will be essential to scrutinize all available indicators with high frequency in order to calibrate the support as closely as possible to what is needed.

***

Read more :

>> Version française : L'offre et la demande, saison 2021

>> Versión en español : Oferta y demanda : temporada 2021

>> All posts by Agnès Bénassy-Quéré, chief economist - French Treasury